Part 4: How to Sell Travel Insurance

If you've never (or rarely) sold travel insurance before, you might be wondering how exactly to go about it.

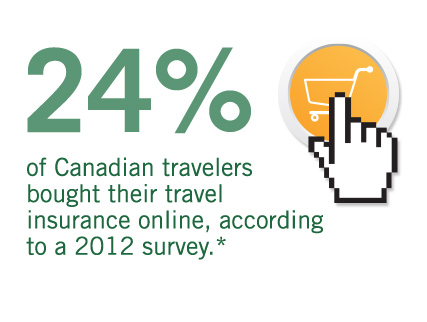

Click the computer screen for online sales tips.

* The Conference Board of Canada: Outbound Canada - Canadian Travel Health Insurance Survey results May 2012.

How to target clients

Here are five great ways to target potential travel insurance clients:

- Cross sell: If you're selling another Manulife insurance product, ask your client if they're planning to travel.

- Know your existing clients: If you have clients that often travel for business or pleasure, keep this top of mind and remind them of the need for travel insurance. Ask if they're expecting visitors from outside Canada.

- Position the need: Tell them why travel insurance is important. Look back to the "Why sell it?" section for details.

-

Respond to common objections:

Here are some common objections and how you can respond.

- "I have coverage through my credit card. I don't need more travel insurance." Most credit card companies have replaced "emergency travel medical insurance" with "travel accident insurance." This is a much different product and doesn't offer the full protection they need when travelling. It usually does not cover hospital, emergency prescription drugs and many other expenses that Manulife Travel Insurance includes. In addition, credit cards have age limitations, pre-existing condition stability exclusions, sports exclusions, etc.

- "I have travel insurance through my group coverage."

Remember to check the details of your group coverage. Not all policies are the same and may not cover the essentials. You can always top up your coverage with Manulife Travel Insurance. - "My government health coverage is enough."

Government coverage does contribute to your out of province medical expenses, but only to a limited extent. It sets dollar limits on covered expenses for medical services outside the province of residence. In this case, you are not fully covered in the event of a medical emergency while travelling. - "Travel insurance is expensive. I can't afford it."

Think of the risks involved if you do not purchase travel insurance. Hospital expenses in foreign countries can cost thousands of dollars. Manulife offers a variety of affordable plans. For as little as $18.90 your clients can purchase Single-Trip Emergency Medical Outof- Province coverage for seven days.† To keep your premiums low, you can choose a deductible option, which offers between 15-50% in savings! If you're travelling with a friend or family member, you can purchase one policy to cover both of you at a 5% savings! Travelling within Canada is a 50% savings!

† Rate for single coverage of a 35-year-old, effective November 30, 2012.

-

Use your marketing materials: Here are some handy sales tools you can use to help you sell this product:

- Travel calendar Who to target and when.

- Brochure Hand out as a lead-generating tool.

- Lead-generating flyers Customize and email or print for clients.

- Buckslips Customize and mail to clients.

- Traveling Canadians Policy or Visitors to Canada Policy For greater product knowledge.

- Posters Display in your office.

Please note: Other exclusions, limitations and conditions apply. See the policy for details.

Now that you've learned the basics of selling travel insurance, what's next?