Whatever savings plans and investments you choose there are ways you can save more. Here are some tips.

If you are a member of a group program, you enjoy many advantages that make saving easier and more profitable than saving on your own – one of these is generally lower Investment Management Fees (IMFs) than you would find with many individual plans.

Everyone’s familiar with the concept of a “group deal” and “group discounts”. It’s the same with IMFs and other expenses related to financial products.

A group savings and retirement program is a comprehensive package that offers useful tools and services to help you save for retirement which are not offered under retail products. The cost of such tools and services is already included in the IMFs.

But remember, IMFs may vary depending on the amount to be invested, the funds selected and the type of product chosen. It is recommended that you compare product fees and features before making a decision on what financial product is best for you.

Don’t throw your money away

IMFs can really eat into your savings. A group program can generally offer you lower fees than a typical individual savings plan.

Let’s say you had an initial investment of $10,000 and contributions of $100 a month over 10 years, a 1% saving could mean up to $2,600 extra in your account - wouldn’t you prefer saving that money over throwing it away?

Save for yourself instead of the tax man

Taxes take a chunk out of every income you make: salary, bonuses, commissions… Here are some ways you can save more for your future and give less to the tax man.

Payroll deductions

If you’re in a group program offered through your employer, contributing with automatic payroll deductions will make your savings go further, and in some cases you can also enjoy immediate tax benefits: since your tax is calculated on a lower amount – your gross income minus your contribution – you pay less tax throughout the year instead of receiving your refund only when you file your personal income tax return.

Regular contributions to an RRSP

Even if you don’t belong to a group plan, you can still save efficiently by setting up regular contributions to your RRSP, and enjoy the tax savings when you file your income tax return.

- Saving a small amount regularly throughout the year (say, $100 monthly) is easier than finding the money for a lump sum contribution at RRSP season.

- You take advantage of Dollar Cost Averaging.

- You get your money working for you longer.

Catch-up on RRSP contributions…painlessly

You still have contribution room in your RRSP, but you’re hesitating to borrow money to catch up? What if you could borrow and repay your loan quickly, without putting a dent in your budget?

All you have to do is make sure your tax refund equals your RRSP loan amount. You can then use your refund to repay your loan

Spousal RRSP and income splitting – save now and later

A spousal RRSP account is a great way to save more for your spouse’s retirement, get tax deductions and pay less taxes on the money you withdraw in retirement.

A spousal RRSP is where one spouse contributes to the plan, but the plan itself is in the name of the other spouse, who owns the plan and any assets of future income from it.

The higher income spouse will contribute to the plan, and then claim the tax deduction, subject to his/her own limit. (For this strategy to be worthwhile, one spouse has to make significantly more income than the other).

The advantage of a spousal plan is the fact that you can split income at retirement for income tax purposes, so that you can keep more money in your pocket and pay less in taxes.

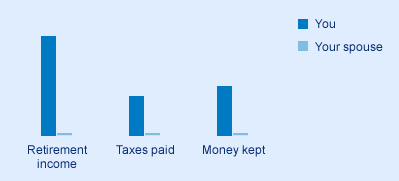

Here’s how it works

Let’s say you do not have a spousal RRSP, and you’re getting all the income at retirement. Here’s what your situation looks like.

Now if you have a spousal RRSP, you can split your retirement income with your spouse for income tax purposes and you each pay a lower marginal tax rate, keeping more money in your pockets.

A spousal RRSP lets you claim tax deductions now, and pay less tax when you retire.

Remember…

- Investing in a spousal RRSP can help you save on income tax now - you don’t have to wait until retirement.

- You have no control over money you invest in a spousal RRSP, and only the spouse in whose name the account was opened will be entitled to all the retirement income deriving from the spousal RRSP.

For more information on the rules regarding spousal RRSPs,

consult the guide on the Canada Revenue Agency web site.

Dealing with debt and growing your savings

One of the obstacles to growing your savings is debt. The more money you owe and the longer it takes you to pay it off, the harder it is to put money away.

What’s more, debt is particularly hard to deal with once you’re retired and your income is reduced.

For some debts, like mortgages and car loans, you have to make specific payments according to a schedule until the debt is paid. You know when it will end.

But other debts, such as credit cards, can seem never-ending because of a combination of high interest rates and too-low payments, and because the debt keeps getting added to.

Here are some ways you can tackle you credit card debt

- Call the credit card company and ask for a lower interest rate. If you’re a good customer, they might agree.

- Consolidate your debt in an account with a low interest rate. This will also help you schedule your payments more easily, as you’ll have one account to worry about.

- Avoid using your cards until they’re paid off. Any purchase adds to your debt and to the interest you pay. Even if you buy an item on sale, your saving can be wiped out by the interest you’re paying.

How long will it take you to pay off your credit card debt?

Try this credit card payment calculator from the Financial Consumer Agency of Canada (FCAC). See how long – or how quickly – it can take you to pay off a credit card.

If you need help

If all fails and debts are too high, consider a Consumer proposal. Talk to an expert on credit counselling such as a bankruptcy trustee. Information is also available on the website of the

Office of the Superintendent of Bankruptcy Canada.

For more tips on dealing with debt, check out the FCAC web site.