Home

Telepsychiatry: Accessible mental healthcare

December 4 2019by: Georgia Pomaki, PhD, CDMP, Leader Mental Health Specialists, Manulife and Chris Anderson, President, Medaca Health Group

-

Canada has a serious shortage of psychiatrists which is likely to worsen, as demand for treatment grows and supply declines.1 Telepsychiatry is an innovative solution for providing greater and faster access to much needed mental healthcare. It expands access in a world where awareness, self-identification, diagnosis and detection of mental illness is increasing demand for services every day. “Eighty-one per cent [of Canadians] are more aware of mental health issues compared to five years ago”, according to a 2015 study.2

Although one in five Canadians are likely to experience mental health issues3, access to psychiatrists, the only medical specialists trained to treat mental illness, has not kept pace. Currently in Canada, fifty per cent of psychiatrists are over 55; only four per cent are under 35.4 While accurate data on wait times are not available on a national basis, 55% of family doctors rank access to psychiatrists from fair to poor.5

What do gaps in mental healthcare mean for employers?

The highest rates of people living with mental illness are between 20 and 403, while millennials report the most stress.6 These age groups are critical for Canadian employers, who are projected to face a labour shortage of about two million workers by 2031.7 Telepsychiatry can help reduce the impact of this supply and demand crisis, help employees better care for their mental health and employers retain productivity and talent.

What is telepsychiatry?

Telepsychiatry connects psychiatrists with their patients in real time and via secure videoconferencing.8 Its efficacy is no longer in question. In fact, telepsychiatry is considered an evidence-based method for assessments and treatment; patient satisfaction and therapeutic alliance are just as good as with in-person care.9

How can telepsychiatry help Canadian employers and employees?

In the workplace, telepsychiatry can augment early intervention strategies of employers and insurers. By significantly reducing wait times, it can facilitate treatment at an earlier, less serious stage of illness, and help prevent initial symptoms from becoming a crisis. This can help employees better manage symptoms while at work. It also helps those who are off work quickly get on the right path to recovery and return-to-work. The benefits of telepsychiatry can be significant when factoring in cost reductions associated with productivity or disability absence duration.

So, what can employers or insurers do?

- Learn about telepsychiatry and how it can deliver mental health assessment and treatment

- Explore how telepsychiatry could help employees at work

- Identify how to make telepsychiatry accessible to employees who are off work due to mental illness

- Raise awareness among employees regarding telepsychiatry

There still appears to be reluctance to embrace telepsychiatry both in the public domain and in the medical community in Canada. Driven by those who have grown up with virtual technology, this reluctance appears to be lessening.

Expanding usage and improved access can lead to faster recovery. This will help reduce pressure on the healthcare system and the human and economic burden of mental illness. With earlier access to care, employees struggling can get better faster, and lead more productive and fulfilling personal and professional lives, contributing to stronger organizations.

If you’re an employer looking for tools to assist your employees, or an individual who would like more information about mental health, you can find resources here that may help.

This article was originally published in the Canadian Life and Health Insurance Association’s Spark!

References

1 Ontario Psychiatric Association, Ontario needs psychiatrists. Chronic psychiatry shortage contributing to Canada’s mental health crisis, 2018.

2 CAMH, Mental Illness and Addiction: Facts and Statistics.

3 Mental health Commission of Canada, Strengthening the case for investing in Canada’s mental health system: Economic considerations, March 2017.

4 Canadian Medical Association 2019.

5 6 Morneau Shepell, 2016. Dollars well spent: How to optimize your employee assistance plan. Presentation by Paula Allen at the Bottom Line Conference, February 24, 2016.

7 Miner, R. The great Canadian skills mismatch: People without jobs, jobs without people and MORE, 2014.

8 CAMH, Telemental Health.

9 Goldbloom, D. & Gratzer, D. Telepsychiatry 2.0. The Canadian Journal of Psychiatry, 62, 10 (October 2017): 688-689.

Home

The Wellness Report - meaningful insights to make decisions easier and lives better

-

The Wellness Report is unique. It’s a employee wellness survey that will help show connections between employee health risks and your organization’s operational bottom line.

Your report is designed to include meaningful and comprehensive insights on how your organization is doing, and it will guide you towards next-steps you could take to make some improvements.

Providing this valuable information into your employees and organization is how we’re making decisions easier, lives better, and organizations healthier.

What do we track?

The Wellness Report, powered by Manulife Vitality, measures mental, financial, and physical wellness. We also evaluate employee engagement, productivity, and check the effectiveness of any existing wellness measures you have. It’s one of the most comprehensive reviews you can get.

And yes, the report is included as part of your plan. There’s no extra cost to check the pulse of your organization.

How does it work?

It’s simple.

Register your organization and have your employees finish a 30-minute online survey. It’s completely confidential and every employee will get their own Personal Health Report. It’s a great way to help employees take little steps today so they can be better financially, physically and emotionally.

A few weeks later, you’ll get an organizational report* that includes valuable new information and insights into your employees and organization.

Of course, the insights you get are tied to your employees’ participation. But don’t worry, we’ve got you covered to help launch and promote the survey to your employees. You’ll get access to helpful tools and resources thought the Toolkit Centre, like email templates and posters to promote the survey.

How do I sign up?

You can register now for a survey period, and we’ll assess your employees online. The first period opens in February.

Stay on target

The Wellness Report will allow you to measure your progress year-over-year and benchmark your organization against others in your sector or across the country.

To register for The Wellness Report or learn more, visit Manulife.ca/thewellnessreport or contact your Manulife representative.

What’s happening to Manulife’s Health Risk Assessment?

If you had a HRA campaign planned for this fall, there’s no worries, you’ll still be able to run with it.

Starting in January 2020, Manulife Health eLinks®, including the Health Risk Assessment, will be removed from our suite of services. By introducing The Wellness Report, alongside Manulife Vitality, you and your members will have access to more comprehensive, modern and digital tools.

If you were doing yearly HRA campaigns, your HMS consultant will be in touch with you to discuss how to transition to The Wellness Report. If you have any question, contact your Manulife representative.

* we need a minimum of 25 participants to produce a report for privacy and confidentiality reasons

The Vitality Group Inc., in association with The Manufacturers Life Insurance Company, provides the Manulife Vitality program. Vitality is a trademark of Vitality Group International, Inc., and is used by The Manufacturers Life Insurance Company and its affiliates under license. Health eLinks is a trademark of The Manufacturers Life Insurance Company, and are used by it and its affiliates under license

Home

BC & Biosimilars: Action required for members on biologics.

October 1, 2019-

What’s changed?

Earlier this year, British Columbia announced its Biosimilar Initiative – strengthening its PharmaCare program by switching patients to biosimilars in place of biologics, for certain indications. The affected biologic drugs are Remicade®, Enbrel® and Lantus®.

Health Canada has indicated that authorized biosimilars are as safe and effective as any other biologic drug*.

When is the change happening?

It depends on what the member is taking the biologic drug for. BC PharmaCare is introducing these changes in two phases – the first happens on November 26, 2019 and the second happens on March 6, 2020.

Please refer to the tables below to see when each biologic is affected.

Phase 1 is effective November 26, 2019:Drug Biologic Biosimilar Taking biologic for: etanercept Enbrel ® Brenzys ® Ankylosing Spondylitis

Rheumatoid ArthritisErelziTM Ankylosing Spondylitis

Psoriatic Arthritis

Rheumatoid Arthritisinfliximab Remicade ® Inflectra ®

Renflexis ®Ankylosing Spondylitis

Plaque Psoriasis

Psoriatic Arthritis

Rheumatoid Arthritisinsulin glargine Lantus ® BasaglarTM Diabetes (Type 1 and 2)

Phase 2 is effective March 6, 2020:Drug Biologic Biosimilar Taking biologic for: infliximab Remicade ® Inflectra ®

Renflexis ®Crohn's Disease

Ulcerative Colitis

What does this mean for BC members taking a biologic?

Members currently taking one of the biologic drugs for the indications listed will need to switch to the approved biosimilar version by the date noted above in order to receive continued coverage. After this date, BC PharmaCare will only cover the biosimilar version – not the biologic.

How will members know?

BC PharmaCare has been proactive in communicating these changes and providing resources for prescribers and pharmacists. It is likely many affected members are already aware of the change. In some cases, they may have already made the switch. Also, we are directly communicating with affected members to let them know what is happening and when.

How does this affect drug claims considered under the Manulife plan going forward?

For members that make the switch before the deadline, there is no change to the process. We will consider any portion unpaid by BC PharmaCare for biosimilars. We won’t consider payments for biologic drugs after the effective date (unless an exception has been granted – see below). This is supported by our current contract wording and no changes to the contract or booklet will be required.

What if a member is unable to switch to a Biosimilar?

BC PharmaCare will consider exceptions on a case-by-case basis for members who are medically unable to transfer to a biosimilar. The member’s doctor would need to submit a Special Authority Request to BC PharmaCare. If approved by BC PharmaCare, they would need to provide Manulife with a copy of their approval and Manulife will consider balances for the biologic drug according to policy provisions.

For more details, visit the BC PharmaCare website or talk to your Manulife representative.

* Biosimilar biologic drugs in Canada: Fact Sheet, Health Canada, 2019

Home

New education for plan members

September 27 2019-

Many Canadians suffer from chronic pain. Often, doctors prescribe opioid painkillers to help patients manage their pain and get through their day. But Canada has an opioid problem. Across the country, people are dying from opioid misuse and overdose.1

Manulife wants to encourage the safe and smart use of these potentially dangerous opioid medications. In April, we widely introduced an Opioid Management Program to help reduce the risk for first time opioid users, or patients who have not filled an opioid prescription in the last six months.

Details about the program, and new educational information about the dangers of opioid use, have been added to the plan member section (Personal tab) of Manulife’s public website. There’s also a short quiz where plan members can test their knowledge about safe opioid use and the current opioid epidemic.

Direct your plan members to the new opioid education materials on www.manulife.ca/opioids

1Evidence synthesis – The opioid crisis in Canada: a national perspective; Health Promotion and Chronic Disease Prevention in Canada, 2018

Encourage them to take the quiz and test their knowledge about opioid medications. Let’s help reduce the risk for people taking opioid painkillers.

(https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6034966/)

Home

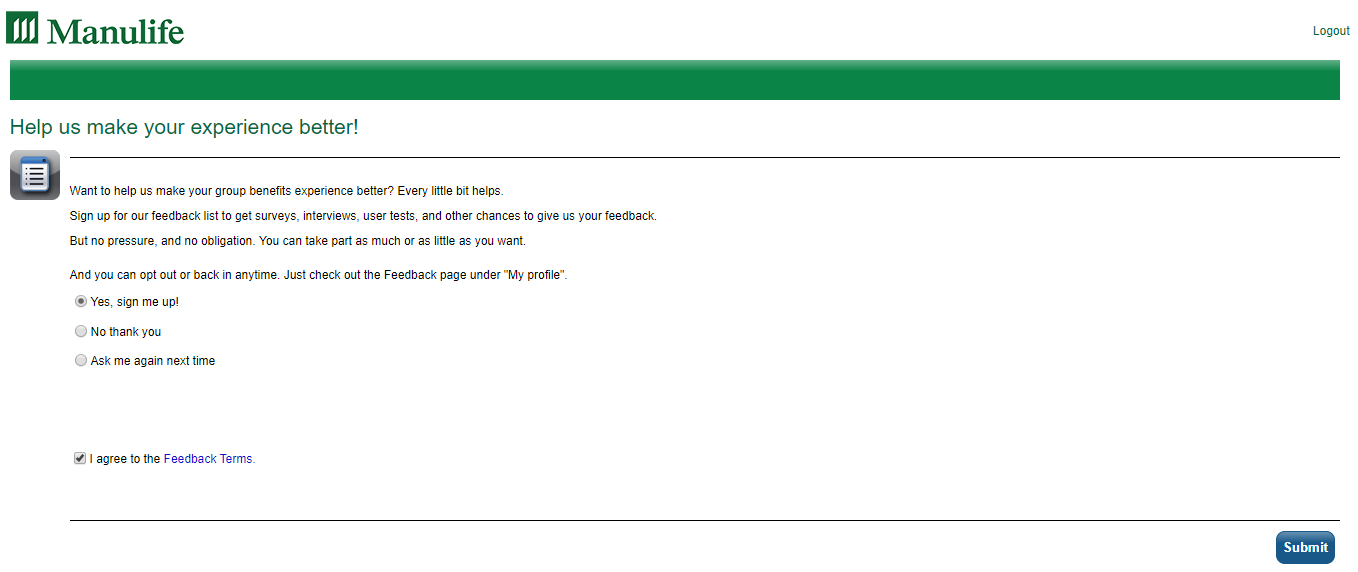

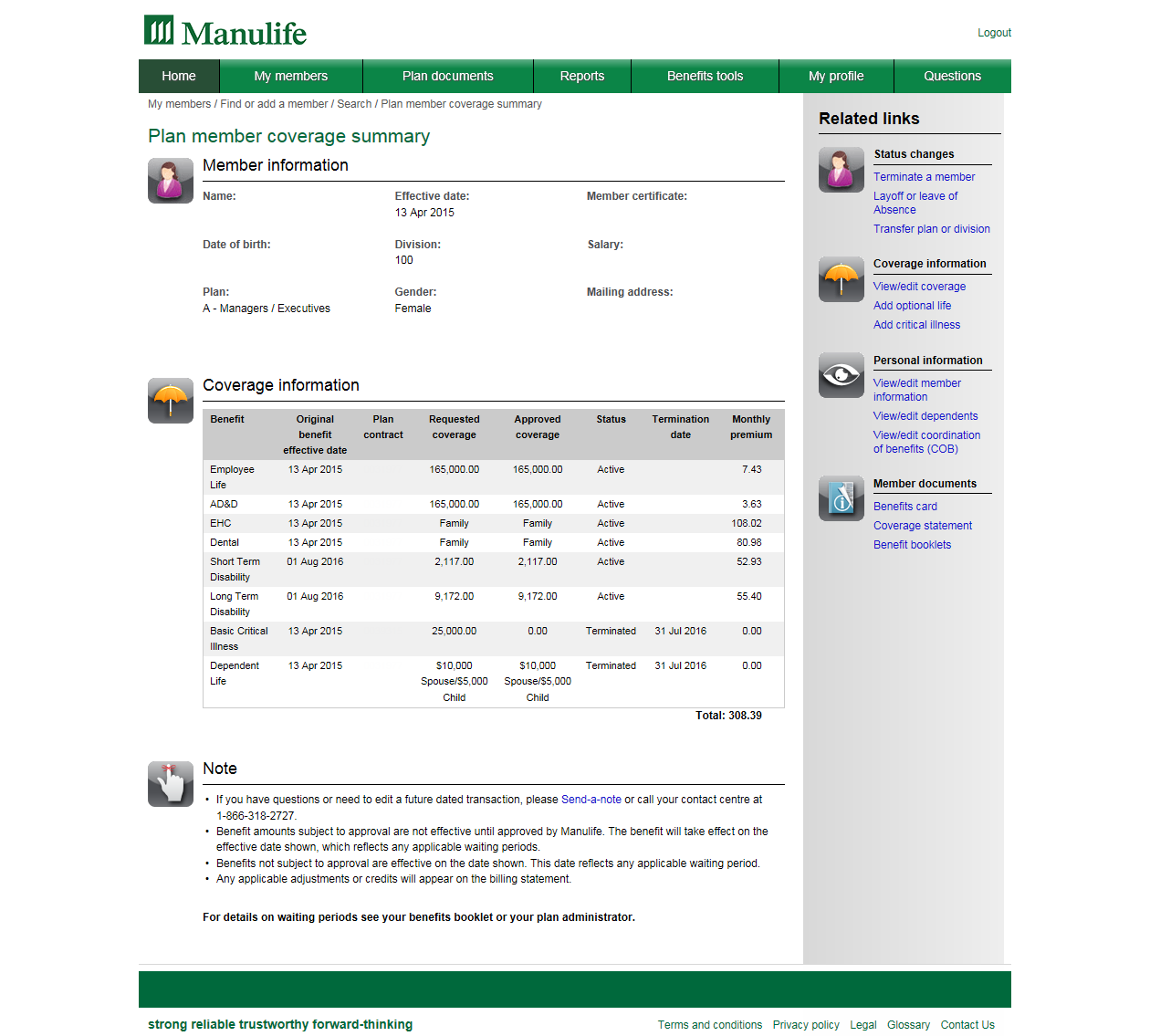

Tell us how we can make the Plan administrator portal better

September 4, 2019-

We’re working on a revamp of the plan administrator portal. Make sure we know how to set it up best for you.

So how do you sign up?

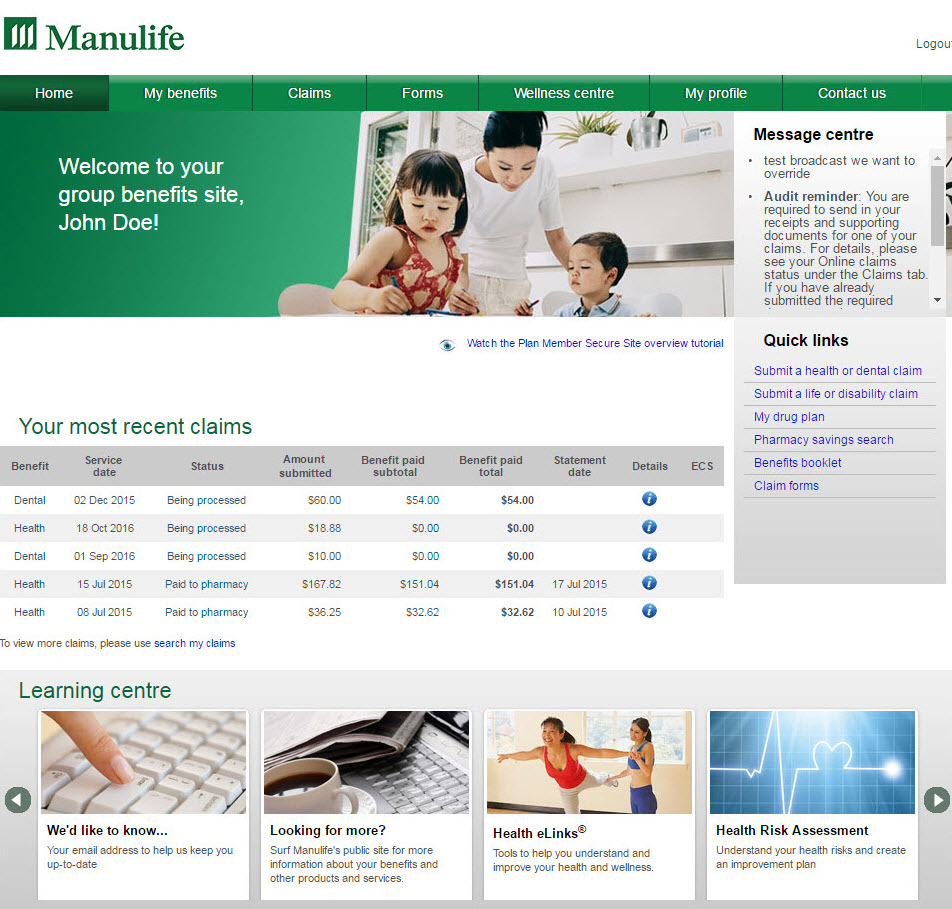

- Just sign in to the secure site and you’ll see a page like this:

- Select “Yes, sign me up” and agree to the feedback terms.

- You missed the page? You can also opt in or opt out of the feedback list at any time through the Feedback page, under My profile section

- Anyone who signs up may be chosen for feedback. We might ask you to do a survey, interview, or test out the site updates.

- Got an invite, but you’re swamped with work? No worries, you can opt out of feedback at any time.

For any questions, please contact your Manulife representative.

- Just sign in to the secure site and you’ll see a page like this:

Home

Gov’t addresses rising drug costs

August 19, 2019-

Manulife supports steps to reduce drug costs

In August, the federal government announced steps to modernize the work of the Patented Medicine Prices Review Board (PMPRB). The PMPRB sets the maximum price for patented medicines in Canada. They set prices by looking at costs in other countries and calculating an average.

The changes mean the PMPRB will have the tools to help lower the costs Canadians pay for prescription drugs. That includes drugs paid for by a government plan or by a group benefits plan.

Summary of changes:

- The list of countries the PMPRB uses to evaluate drug prices in Canada will be changed so prices in Canada are judged against countries that have a similar population, economy and health care system.

- The PMPRB will have access to the actual market price of medicines in Canada (instead of inflated list or "sticker" prices). This information will help the PMPRB decide if a price is reasonable when setting the upper limit for the cost of a drug.

- The PMPRB will have the ability to consider whether the price of a drug reflects its actual value for patients.

Manulife is very supportive of these changes. We’ve been working with the government and the industry to find solutions to lower the cost of medicine. We don’t yet know exactly how or when this change will affect employer drug plans, but the government’s announcement is very encouraging.

Read more

After the government’s announcement, Manulife issued this press release.

Home

Moving to Pay-Direct Drug (PDD) Plan

-

We’re moving reimbursement clients to a Pay-Direct Drug (PDD) Plan.

As a plan sponsor, we understand that balancing the needs of your plan members and managing the cost of your drug plan is challenging. With a Pay-Direct Drug (PDD) plan, there are additional features and programs that help ensure plan members are reimbursed for the treatments they need, but also help keep your drug plan costs sustainable.

Why we’re doing it

It’s about offering you better cost management features and more plan design options:

- Enhanced provincial integration

- Product listing agreements

- Refined pricing controls on drugs costs

- Drug Utilization Reviews (DUR)

- Stronger fraud prevention and audit controls, including narcotics management

- Managed drug formularies, automated prior authorization, preferred providers, etc.

- Access to future programs

And creating an improved experience for your members with:

- On-the-spot claims processing and payment, which can include coordination of benefits if the second plan also has a PDD option

- Online drug look-up tools

Once they are moved over to a PDD plan, members will be able to get their benefit card online or on the Manulife Mobile app.

How we’re doing it

Starting with the February renewals, we’re moving reimbursement drug plans to Pay-Direct Drug (PDD) plans and adding mandatory generic substitution.

If you have a reimbursement drug plan, you’ll be hearing more from us shortly.

For now, if you have any questions, reach out to your Manulife representative

Home

Quebec RAMQ out-of-pocket maximum increases

-

Plan sponsors with plan members who reside in Quebec must offer prescription drug coverage that meets the minimum legislative requirements set by the Régie de l’assurance maladie du Québec (RAMQ).

On July 1, 2019, the following changes were applied to private plans as announced by RAMQ:

- The maximum annual out-of-pocket drug expenses that plan members are required to pay increased from $1,087 to $1,117.

- The plan member’s co-insurance level (maximum out-of-pocket expenses) increased from 34.9% to 37% of the prescription cost.

On January 1, 2019, the maximum coverage for Quebec smoking cessation products stays at $800.

Quebec's drug plan legislation requires that private drug plans are at a minimum equal to the drug coverage provided by the RAMQ. As such, all drug plans covering Quebec plan members must provide coverage for smoking cessation products that are listed on the RAMQ Formulary.

Manulife will not automatically update applicable contracts to reflect the RAMQ July 1 out-of-pocket expense increases. If your contract duplicates coverage provided by RAMQ, and reads an annual out-of-pocket expense of $1,087, you must submit an amendment to your account executive requesting that your contract be updated to match RAMQ's 2019-2020 minimum requirements.

Contracts that do not state a specific dollar out-of-pocket amount do not require updating.

Questions?

Please contact your Manulife Representative.

Home

We’re now @manulife.ca

-

Action might be required if you use encryption

As of May 1, our email addresses in Group Benefits changed from @manulife.com to @manulife.ca.

This change includes Manulife employee email addresses, as well as email addresses used for shared inboxes and various processes.

Manulife is a Canadian company. We started in Canada, and while our business now extends around the world, we’re proud of our Canadian heritage. We’ve adopted the .ca address when communicating with our Canadian customers.

Please update your records

If you haven’t already done so, please make sure email addresses are updated in all relevant contact lists, records, and in processes where emails are auto-generated. However, be assured, during the transition we will continue to receive any messages sent to the old (.com) address.

Similarly, if you use one of our Group Benefits department email addresses (example: ABCdepartment@manulife.com) please begin using the .ca address (ABCdepartment@manulife.ca).

An important note about encryption

If your organization uses encryption, please ask your Technical Services team to re-apply the TLS encryption rule to the @manulife.ca address.

Over time, other areas of Manulife will also adopt the .ca email address. If you are affected, you will receive information about the timing of those changes when they are scheduled.

Home

In-Canada Medical Travel

-

Our new benefit can help with costs when members travel long distances for healthcare.

When you’re unwell, the last thing you want to worry about is if you can afford to get better. As Canadians, we enjoy access to quality public healthcare – but what if you need to travel far distances to access that healthcare?

With In-Canada Medical travel, members and their eligible travel companions can get coverage for travel expenses when they need to travel long distances to get healthcare – reimbursing up to $1,000 in eligible expenses for roundtrips over 1,000km (including travel, accommodations and meals) every two years.

Coverage details:

- $1,000 every 24 months for round trips over 1,000km

- Up to $75 per day for accommodations

- Up to $50 per day for meals

In-Canada Medical Travel helps ensure remote members can afford to get where they need to, when they need healthcare - so they can get better, and back to work, sooner. For more details, talk to your Manulife representative today.

Home

Amendments to Regulations under the Insurance (Vehicle) Act BC

-

In 2018, British Columbia made changes to the Insurance (Vehicle) Act. Bill 20 – 2018 Insurance (Vehicle) Amendment Act, 2018 As of May 17, 2018, insurers’ no longer have subrogation rights for motor vehicle accidents in BC. Manulife updated health, dental and disability processes to ensure that we did not actively pursue reimbursement for expenses paid, in the event of a settlement of a motor vehicle accident (MVA) in BC. ADVANCE

Effective April 1, 2019, there were amendments to the Insurance (Vehicle) Act Regulations to clarify changes to ICBC benefits. ICBC is the 1st payor for additional health care practitioner services and some medical supplies when related to a motor vehicle accident (MVA). This includes:

- Acupuncture, chiropractic care, clinical counselling, kinesiology, registered massage therapy, occupational therapy, physiotherapy and psychology.

- Up to $1,000 for necessary medical supplies and services such as naturopathic treatments, foam rollers, and compression stockings.

There is a 60-day time limit for claimants to submit receipts to ICBC, previously it was up to two years.

For additional information, please read changing auto insurance BC.

There is no change in Manulife’s disability management process, as ICBC remains second payor for disability benefits.

Effect on members

Manulife will adjudicate claims for practitioner services and medical supplies from first dollar, based on plan design unless we know the patient was in a motor vehicle accident.

For members incurring expenses relating to a MVA:

- For paramedical services, practitioners have been told they can bill services related to the MVA directly to ICBC.

- For a list of treatments and fees, please read the ICBC's Recovery and Treatment Guide

- Any balance not paid by ICBC will be billed to the patient. Any balance not paid by ICBC can be submitted to Manulife for consideration.

- If the practitioner chooses not to bill ICBC directly, the patient must submit their claim to ICBC. If the patient sends the claim to Manulife instead of ICBC, and we know the treatment is related to a MVA, the claim will be rejected. The member must submit to ICBC first for consideration.

- For claims submitted where our records show the member was in a MVA, and the medical supply is eligible for ICBC funding, we will reject the claim. Once we have documentation showing that the expense was not eligible through ICBC, or there is a balance that was not paid, Manulife will adjudicate the claim based on the members plan design.

If you have questions, contact your Manulife representative.

Home

Manitoba to reduce retail sales tax on insurance

-

In its 2019 budget, the Manitoba Government announced it’s reducing the retail sales tax (RST) rate from 8% to 7% on July 1, 2019. Read: Manitoba Government Information Notice.

The Manitoba RST applies to the following group benefits products:

- Accidental death and dismemberment (AD&D)

- Critical illness

- Disability – short and long term

- Life

The RST does not apply to extended health care, dental benefits and Administration services only (ASO) arrangements.

The RST reduction applies to you…

If you’re a plan sponsor with employees in Manitoba with AD&D, critical illness, disability, and/or life coverage.

Plan sponsors who receive a monthly bill from Manulife…

You will see a 1% reduction in your July bill.

Plan sponsors with AdminAdvantageTM

If you’re an AdminAdvantageTM client and receive a payroll file, you will see this change in your payroll for July 1.

Self-administered plan sponsors who submit their bill to Manulife…

If you prepare your own bills, you must apply 7% RST for the portion of your premium that relates to Manitoba employees starting July 1, 2019.

Third-Party Administrators (TPA)

If you’re registered or required to be registered to submit the Manitoba RST to the government directly, you will need to change your billing systems to reduce the RST for July 1. If you are not registered to submit the Manitoba RST to the government directly, Manulife will collect and remit the tax.

Questions?

Please contact your Manulife representative.

Home

Healthcare Online: An innovative way to look at healthcare

-

Studies show that 68% of Canadians skipped a scheduled doctor’s appointment or even avoided seeing one when they were sick1. This is either because of long waiting times or because they just couldn’t book an appointment at a time that worked for them. Not only does this delay their treatment, but it can also impact absenteeism, presenteeism and disability in organizations, leading to loss of productivity and lower engagement levels2.

So how can we help? By launching Healthcare Online! 7 out of 103 Canadians say they would take advantage of virtual physician visits if they had the chance. Healthcare Online is a suite of services that will give them that advantage. Employees will have online access to healthcare professionals through web and mobile applications so that they get the care they need when they need it – at home, at work or on the go.

Primary care is the first service available under Healthcare Online. With this service, employees will get 24/7 online access to doctors and nurses that can diagnose and treat their health concerns. These professionals will give advice, prescribe and renew existing prescriptions, write labs and imaging requisitions, and even refer to specialists and allied health professionals.

Our Healthcare Online

Healthcare Online is a game changer for the healthcare industry, but how will our service stand out from the rest of the Canadian market?

In three simple ways: Flexibility, Quality and Patient Care Experience

- Flexibility: you can offer these services as part of your benefits package or simply give employees access to preferred pricing.

- Quality: Healthcare Online is a curated service – we only retain the best-in class vendor for each service.

- Patient Care Experience: moving forward, we’ll be able to refer patients to other healthcare services and/or products like Manulife Vitality, Employee Assistance Program, or Health Risk Assessment. This will help them in their overall wellness journey.

What’s the real value to organizations?

A BC study4 conducted in 2015 showed that among patients who had an online physician visit:

- 87% avoided work absence

- 57% avoided an in-person visit with a doctor or their regular place of care

- 98% saved travel time

Healthcare Online combines timely care, convenience and better overall health for your employees. They’ll be able to bring their best to work so they can help your organization thrive.

Access to quality care online can be truly beneficial to organizations. Contact your Manulife representative to learn more.

1 IPSOS (2017), Seven in Ten Canadians (68%) Have Skipped Seeing a Doctor

2 Manulife Financial Wellness Study – 2016 Index

3 Ipsos, Inspiring a future of better health (2018)

4 Virtual Visits in British Columbia: 2015 Patients Survey and Physician Interview Study

Home

New e-learning tool to help your plan members claim smart-er

-

We’re excited to tell you that our Claim Smart e-learning tool is now available. It’s a fun and interactive way for your plan members to find out how claims smart they are when it comes to avoiding the misuse of their benefits. It’s also a great way to share useful tips to help your members become even better at protecting their benefits plan against fraud. Check out how claim smart you are.

A French version of the e-learning tool will be available shortly, so watch out for an update!

To learn more about our latest fraud prevention campaign, look out for #ClaimSmart2019 on our social media channels, or visit manulife.ca/planprotect.

If you have any questions or would like any further information, please contact the Group Benefits Investigation Services team at shareandprotect@manulife.com

Home

New Post-Retirement Disability Benefit

-

Effective January 1, 2019, the Government of Canada has added to the Canada Pension Plan (CPP) a Post Retirement Disability Benefits (PRDB) program to give protection to CPP retirement pension recipients. The Canada Pension Plan Disability (CPPD) benefit will not be impacted by the PRDB.

What does this mean?

The new post-retirement disability benefit will provide disability income protection to early retirement pension recipients.

To be eligible for PRDB, a pensioner must:

- currently receive a CPP retirement pension for more than 15 months;

- not be eligible for CPPD;

- be between 60 and 65 years old;

- have earnings and contributions to meet minimum qualifying period as of January 1, 2019; and

- suffer from a disability as defined by the CPP legislation, that began after the effective date of their CPP retirement pension payments.

The benefit:

Eligible pensioners will receive a flat rate PRDB of $496.36 for 2019 in addition to their CPP retirement pension.

When does the benefit stop?

The PRDB stops when the earliest of the following events occurs:

- The person is no longer disabled under the CPP legislation;

- The person reaches age 65;

- The person dies

What does this mean at Manulife?

As per the Disability contract, if the PRDB is awarded, it will be an offset from Manulife’s disability benefits. The offset will be the same as a CPPD benefit:

- If the member submits a claim for disability benefits where the member has been, or soon will be, in receipt of CPP retirement pension, Manulife may ask the member to either convert to CPPD or apply for PRDB.

Service Canada will contact CPP pensioners who were previously denied for CPPD, to inform them that they may qualify for PRDB.

Glossary of acronyms:

CPP: Canadian Pension Plan

CPPD: Canada Pension Plan Disability

PRDB: Post Retirement Disability BenefitsIf you have questions, please contact your Manulife representative.

Home

Pointing plan members to providers they can trust

-

Positive results for plan members and their employers.

A year ago, plan members in the London, Ontario area were introduced to Manulife’s Trusted Provider Network. The pilot program was created to improve plan members’ experiences in sourcing the medical supplies they need. Each trusted provider in the network was screened and confirmed to deliver a high-level of professionalism and ethical service to their customers.

Easier process with fewer complaints and lower risk

Plan members using the Trusted Provider Network get their medical supplies without needing a pre-payment audit. It’s a more efficient claims experience for members, and the number of plan members using one of the trusted and reputable providers in the network has gone up. There’s also been a decrease in the number of members who choose to use providers who are not part of the Trusted Provider Network.

In the past, some dishonest providers offered incentives that encouraged plan members to claim for supplies when there wasn’t a true medical need. The Trusted Provider Network helps remove that risk, resulting in fewer false claims. In the 12 months since the pilot started, participating groups have seen fewer inquiries and interventions when claims are made through the network. For example, one group’s claims for orthotics and elastic stockings reduced by 49%.* This is a strong sign that plan members are using the network, and only claims based on a genuine medical need are being submitted to the plan.

Expanding the pilot

Based on the success of the program, more plan sponsors wanted to join the pilot. Working with these groups, the Trusted Provider Network was expanded to the Hamilton and Niagara regions.

The success of the program to date tells us plan members, plan sponsors, and participating providers value the approach and support the initiative. Building the network will take time, but Manulife welcomes the chance to work with our clients to gradually expand to new markets. It’s a pro-active effort to improve plan members’ experiences while taking concrete steps to protect the plan sponsor’s interests and investment.

*Source: Manulife Group Benefits

Home

Quantity limits on blood glucose test strips

-

Effective April 1st we are modifying our administrative practices and applying limits on blood glucose test strips.

- For patients managing diabetes with insulin the yearly maximum will be 3,000 test strips.

- For patients on oral diabetes medication or using diet and exercise alone to manage their diabetes will have coverage for up to 400 strips.

This change applies to drug plans with coverage for diabetic supplies. If your plan already has limits in place, the new limits wouldn’t apply. Plans that currently have limits on blood glucose test strips that would like to align with ours, please contact your Manulife representative.

Changes in administrative practices are important to help manage drug costs for both the plan sponsor and member as well as reduce misuse and abuse. Applying limits also encourages proper testing practices for optimal patient outcomes.

Provincial plans have introduced limits, but overall align with Manulife’s limits (with minor differences by province).

If you have any questions, contact your Manulife representative.

Home

March is fraud prevention month

-

We believe most people are honest and don’t intend to misuse or abuse their benefits plan. But, errors can happen when plan members are disengaged, misguided or misinformed.

We continue to focus on proactively engaging plan members to be claims smart all year round. How do plan members become claims smart? By making well informed choices when selecting a provider and submitting claims.

To help deliver this strategy, we developed a library of ready-to-use campaign materials. These materials will help you to engage your employees, encourage improved claims behaviour and help foster a protective culture towards benefits plans. That’s claims smart!

We’re continuing this strategy by developing fresh campaign materials over the coming months, for you to use to educate your plan members to be more claims smart and make well informed choices. In line with Manulife’s digital transformation, and in recognition of March being fraud prevention month, we’re launching a new e-learning tool - a fun and interactive way for your plan members to find out how Claims Smart they are! They’ll also get some useful tips on how they can get even better at protecting their benefits plan.

For more on this campaign, look out for #ClaimSmart2019 on our social media channels.

If you have any questions or would like any further information, please contact the Group Benefits Investigation Services team: shareandprotect@manulife.com

Home

There’s an opioid crisis in Canada.1 Our new opioid management program helps protect you and your members.

-

We’re looking at the problem in a new way. Instead of managing opioid use by limiting access, our focus is on prevention and early intervention.

We believe promoting the safe and smart use of opioids for members who are using them for the first time or haven’t had an opioid prescription for six months, protects their health and well-being.

They’ll be better able to recover and get back to work sooner, healthier, and with less chance of addiction or health issues caused by overuse and side effects. And when that happens, they’re better able to continue bringing their best to work each day, helping to drive their organization’s success.

Our opioid management program will automatically be added to all pay direct drug plans (Except in Quebec) on April 1, 2019.

21.5 million

opioid prescriptions dispensed in 201623998 Canadians

died from opioid-related overdoses in 20173How opioid management helps protect your plan

By helping prevent chronic or long-term use, we’re not only helping members get back to work quicker and healthier. We’re also protecting you, our sponsors, from several other costs associated with opioid use.

When fewer plan members need ongoing, long-term treatment, their plan’s drug costs and potential addiction management costs will be lower. And there will be less drug waste, with fewer unused opioids lingering in households, where they potentially pose a safety risk to other family members and their communities.

2 steps we’re taking to help members manage their opioid prescriptions:

- Start with a short-term supply.

By initially filling a small portion (up to 7 days) of a prescription, pharmacists have an early opportunity to check in on any side effects a member may have and monitor their risk of tolerance and dependence. It’s not about limiting access. According to the US Centers for Disease Control and Prevention, most acute pain that needs opioid use ends in 3-5 days. More than 7 days is rarely needed.4 But often, more than this amount is prescribed. We’re taking steps to help verify a member needs ongoing pain relief before they fill the rest of their prescription. - Try short-acting opioids first.

It’s considered the most effective way to produce the best health results for people who are prescribed opioids. For someone who is not a current opioid user, long-acting opioids can present a serious health risk. Harmful reactions, like a lowered breathing rate or overdose, are greatly increased. And tolerance for and dependence on opioids can build quickly.5 By requiring a short-acting opioid trial period first, we’re helping to reduce the risk of side effects and chronic use.

Manulife’s leading-edge opioid management program was developed in collaboration with Express Scripts Canada®. This proactive solution is in place to help improve plan member awareness of the risks associated with opioids. It provides a balance between control and appropriate use for members with a new opioid prescription and promotes the proper use of opioids for members who truly need them for ongoing pain management.

Next steps

As the program grows, we’ll share our insights on opioid use with you and provide education materials for your members.

If you have any questions, contact your Manulife representative.

1 Canada’s opioid crisis (https://www.canada.ca/en/services/health/campaigns/drug-prevention.html). Government of Canada

2 Pan-Canadian Trends in the Prescribing of Opioids, 2012 to 2016. Canadian Institute for Health Information, 2016

3 National report: apparent opioid-related deaths (https://www.canada.ca/en/health-canada/services/substance-use/problematic-prescription-drug-use/opioids/data-surveillance-research/harms-deaths.html#s1.3). Health Canada, December 2018

4 DC Guideline for Prescribing Opioids for Chronic Pain – United States (https://www.cdc.gov/drugoverdose/pdf/Guidelines_Factsheet-a.pdf). Centers for Disease Control and Prevention, U.S. Department of Health and Human Services, March 18, 2016

5 Opioids Monograph (https://www.e-therapeutics.ca/search). Canadian Pharmacists Association, September 2018

Home

Helping to cut through the haze of confusion around medical marijuana

-

As you know, our unique medical marijuana program launched last September is available to you and your members. As you consider offering coverage for medical marijuana to your members, we wanted to make sure you have the information you need.

To learn more about how our fully integrated program works, check out this feature sheet.

What you can do

We encourage you to use this feature sheet to help take the confusion out of medical marijuana.

Of course, we’re also available to help. If you have any questions about the program or are interested in offering coverage for your members, contact your Manulife representative.

-

Feature sheet

Home

CLHIA collaboration launches new fraud prevention campaign

-

Benefit fraud is still a hot topic in our industry. Plan sponsors are demanding to know what the industry is doing to tackle it.

What are we doing?

We recently launched a campaign designed to engage and inform plan members to make smart choices when submitting claims. Our aim is to empower plan members to protect their benefits from fraud and misuse and to encourage them to report any suspicious activity they witness with our new Share & Protect e-form. The e-form helps them easily share concerns with the information we need to investigate efficiently.

What is the CLHIA doing?

The CLHIA is a not-for-profit, membership-based organization that represents 99% of Canada's life and health insurance companies. They recently launched their own awareness raising campaign, developed in collaboration with group benefits providers, including Manulife.

The campaign is centred around the theme ‘Real crime = Real consequences’, focusing on the severity of the crime and the real consequences of engaging in it.

Working together!

The CLHIA campaign materials complement Manulife’s, so they can be used together to raise awareness of the full cycle of benefit fraud and misuse - from making a poor claim decision, to experiencing the consequence of being caught committing benefit fraud.

YOU can be part of the solution!

Resources developed through this collaboration include a dedicated website, videos, and social media posts. Please share them with your plan members to raise awareness of the risks involved in engaging in benefit fraud.

Home

Smart pill bottle pilot – An advanced solution for closer follow-ups and intervention

-

We’re excited to announce a first-to-market pilot that uses smart pill bottle technology to improve the way plan members take their medications. Plan members enrolled in Manulife’s Specialty Drug Care Program through Bayshore® HealthCare, and are taking a pre-selected medication for Multiple Sclerosis, qualify to join the pilot.

The Pillsy® Smart Cap tracks if a member opens and closes their bottle to take a dose of medication. If a member forgets to take their medication, the Pillsy Cap will send automated reminders, such as beeping and blinking and text message alerts. It also sends reliable information to a Bayshore nurse case manager who can identify and help prevent any potential drug-related issues.

Improper medication use is a very common issue. The pilot will help us to identify if a smart pill bottle technology, combined with the nurse case manager intervention can promote proper medication use, lead to better health outcomes and reduce medication waste. We will also collect feedback and insights from the plan members’ experiences.

Please contact your Manulife representative for more details.

-

Learn more about smart pill bottles

The functionality to generate a refill request shown in this video is not available in the Manulife smart pill bottle pilot program.

The functionality to generate a refill request shown in this video is not available in the Manulife smart pill bottle pilot program.

-

Fact sheet

-

© Bayshore Specialty Rx Ltd. 2018. All rights reserved. The Bayshore logo is a registered trademark and Specialty Drug Care logo is a trademark of Polar Valley Investments Ltd. and used herein under licence. Bayshore's community-based health care services are governed by ISO 9001 quality standards. Bayshore is committed to ensuring the confidentiality and protection of personal information.

Pillsy is a registered trademark of Pillsy, Inc Incorporated, in the United States.

Home

Bill 28 (2015) update – Quebec adds new pharmacy services

-

This applies to plan sponsors with plan members who are residents of Quebec.

Since June 20, 2015, Quebec pharmacists have been able to bill private plans for four professional services to their patients because of Quebec’s Bill 28.

On August 29, 2018, the Minister of Health and Social Services, Quebec, reached an agreement with the Association Québécoise des Pharmaciens Propriétaires (AQPP) that allows pharmacists in Quebec to perform three new professional services.

Effective date October 31, 2018 plan sponsors providing drug coverage to their plan members in Quebec are required to reimburse these services:

- Administration of a drug for teaching purposes. This means the pharmacist demonstrates to the patient* the proper self-administration of an injectable drug, including subcutaneous (into the fat layer under the skin), intradermal (into the layer under the skin), or intramuscular (into the muscle). This service is limited to one per year per insured person and per prescribed drug.

*The “patient” is either the plan member or the plan member’s dependent. - Substitute a prescription drug when there is a supply shortage of the prescribed medication in Quebec. First, the pharmacist must confirm that the prescribed drug is not available in two other pharmacies and two other wholesalers, and that the Régie has not proposed a replacement drug; then the pharmacist can substitute an alternative drug from the same therapeutic class. This service is limited to one per supply shortage period provided treatment is continued with the alternative drug.

- Adjust a new prescription (shape, quantity or dosage) for patient safety to:

- reduce the side effects related to a drug

- manage drug interactions

- prevent organ failure

- treat appropriately according to the patient’s hepatic/renal clearance

- provide a dose appropriate to the patient’s weight

- improve tolerability

- correct a dosage mistake

Adjustment listed below are not eligible for reimbursement:

- the drug form (e.g., switching from an oral solution to chewable tablets), or

- the quantity dispensed, or

- the dosage frequency without altering the original total daily dose

How this affects your plan

For plan sponsors with members in Quebec, the three new services are eligible under your drug plan effective date October 31, 2018. These services are expected to have minimal impact to claims experience.

How this affects your plan members

Since these services are listed under the Régie de l’assurance maladie du Québec (RAMQ) drug plan, the plan member’s co-payment accumulates towards the RAMQ maximum annual out-of-pocket amount.

If you have questions, contact your Manulife Representative.

- Administration of a drug for teaching purposes. This means the pharmacist demonstrates to the patient* the proper self-administration of an injectable drug, including subcutaneous (into the fat layer under the skin), intradermal (into the layer under the skin), or intramuscular (into the muscle). This service is limited to one per year per insured person and per prescribed drug.

Home

BC Bill 20 ends insurer subrogation rights in vehicle accidents

-

British Columbia’s Bill 20, the Insurance (Vehicle) Amendment Act, 2018, included changes to Section 83 of the Insurance (Vehicle) Act. These changes took effect May 17, 2018.

One big change is that insurers’ have no subrogation rights for motor vehicle accidents in BC. This change affects injury and death claims caused by a vehicle, or by someone’s use or operation of a vehicle.

Manulife has aligned our administrative processes with this change.

*Note: For insurance, subrogation is when an insurance company pays a claim to the insured, and then recovers some or all the payment from the party who was at fault in the accident.

If you have questions, contact your Manulife representative.

Home

2019 changes to Maximum Insurable Earnings, Employment Insurance, and the Quebec Parental Insurance Plan

-

The Canada Employment Insurance Commission and Canada Revenue Agency have announced the 2019 changes to Maximum Insurable Earnings, and premiums for employment insurance. These changes take effect January 1, 2019.

Maximum Insurable Earnings (MIE)

The MIE will increase from $51,700 to $53,100.

Employment Insurance (EI)

The EI premium rate will be $1.62 per $100 of insurable earning. This is a $0.04 decrease from the 2018 rate and a $0.056 decrease for employers.

Quebec Parental Insurance Plan (QIPP)

The QPIP premium rate will be reduced by $0.05 per $100 of insurable earnings to a premium rate of $1.25 ($1.75 for employers).

Maximum Employment Contribution

The maximum EI contribution will increase by $2 to $860.22 for workers and up $2.80 for employers to $1,204.31 per employee.

In Quebec, the maximum EI contribution will decrease by $8.35 to $663.75 for workers and down $11.69 for employers to $929.25 per employee.

For self-employed Canadians who have opted-in to the EI program, the annual earnings required to qualify for special benefits will increase to $7,121, up from $6,947 for 2018.

Plan sponsors

We are updating our systems to accommodate plan sponsors with their Weekly Indemnity/Short Term Disability benefit tied to the EI maximum.

If you have questions, speak with your Manulife representative.

Home

Representing your interests in the National Pharmacare discussion

-

For many months, Manulife has been working with the Canadian Life and Health Insurance Association (CLHIA) and organizations like the Business Council of Canada and the Ontario Chamber of Commerce, as well as meeting with federal and provincial governments, to represent your interests in the discussion about National Pharmacare. Such a program could introduce universal access to some prescription medications for Canadians, paid for by public funds. Like the federal government, we agree all Canadians deserve access to a comprehensive and affordable drug plan. We’re concerned especially about the estimated 10% of Canadians who either don’t have a prescription drug plan or have inadequate coverage to meet their needs1.

Manulife supports government goals

In a recent submission to the Advisory Council on the Implementation of National Pharmacare, Manulife expressed its support for the government’s goal to improve the overall health, well-being, and quality of life for all Canadians. At the same time, we believe any national pharmacare solution needs to be careful not to erode the value that group benefits plans bring to the Canadian economy.

Workplace benefit programs contribute to the overall health and wellness of Canadians. Employers and union groups provide these plans because workers value the variety of services covered by the plans. They enjoy the ease with which they can interact with their plans to obtain information or reimbursement for expenses. It’s important to point out that group benefits plans go far beyond simply paying for prescriptions: they bring together a variety of services and features that can support and help protect the overall health and well-being of the individual.

A minimum standard

Manulife believes every Canadian should have drug coverage that equals or exceeds an agreed upon standard. We note that almost all Canadians covered by workplace drugs plans, and many of those who access drugs through a public plan, already have coverage that would exceed any national standard that is likely to be established. Therefore, we believe the government can achieve its goal of universal coverage by improving the current system, giving employers incentives to offer benefit plans that include drug coverage, and establishing a base level of coverage that all private and public plans must provide.

In the coming months, Manulife will continue to work with the government on this important issue. If you have any thoughts or concerns that you would like to share, please speak to your Manulife representative.

Further reading : CLHIA submission to Advisory Council on National Pharmacare

Manulife is not responsible for the availability or content of external websites.

1 Source: Federal Cost of a National Pharmacare Program; Office of the Parliamentary Budget Officer, Canada; September 28, 2017

Home

Helping make lives better through two health recovery initiatives

-

Early intervention treatment for Musculoskeletal Disorders

Today, Canadians spend most of their days sitting1 . According to recent studies, only 18%2 of Canadians get enough exercise – 150 minutes per week and 64%3 of adults in Canada 18 and over are overweight or obese. This inactive lifestyle can affect their health and ultimately organizations’ health. A large portion of the working population experience Musculoskeletal (MSK) disorders - low back pain, neck strain, carpal tunnel. This can result in increased presenteeism, sick leave, disability or early retirement4. It represents 28%5 of Manulife’s disability claims.

We want to help Canadians suffering from MSK disorders. So, we partnered with Lifemark to provide an early multi-disciplinary intervention MSK disorders program with a personalized approach – individualized rehabilitation program and return-to-work planning to improve recovery times and health outcomes. Through this program, injured employees can safely and more quickly get back to health and return to work.

This program is unique to Manulife and is offered to all clients in Canada.

Dedicated professionals to help navigate the Canadian healthcare system for medical specialists

Did you know that the median waiting time between referral from a general practitioner and receipt of treatment in 2017 in Canada was 21.2 weeks6?

Navigating the healthcare system can be hard for many Canadians and this can affect an organization’s bottom line too. We’re seeing:

- high-stress levels

- health deterioration

- presenteeism/absenteeism

- disability leaves

Our partnership with Medical Confidence™ helps plan members navigate the healthcare system much easier and get access to the help of specialists faster with:

- dedicated, personalized nurse care support – identifying the right specialist, scheduling appointments, reviewing diagnostic testing, coaching and preparing questions for the appointment

- access to a network of more than 11,000 leading specialists across 800 subspecialties

This program – offered to all our clients in Canada - has delivered amazing results.

- Up to 25%7 decrease in claim duration

- Up to 20%7 decrease in an organization’s benefits and disability related costs

Interested in learning more about these two innovative health recovery programs to help employees bring their best to work? Contact your Manulife Representative.

1 Daily average time spent in hours on various activities by age group and sex, 15 years and over, Canada and provinces (2015) https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=4510001401 2 Statistics Canada, 2014 and 2015 Canadian Health Measures Survey, https://www150.statcan.gc.ca/n1/daily-quotidien/170419/dq170419e-eng.htm 3 Public Health Agency of Canada, Tackling Obesity in Canada: Obesity and Excess Weight Rates in Canadian Adults (2017) https://www.canada.ca/content/dam/phac-aspc/documents/services/publications/healthy-living/obesity-infographics-adults.pdf

4 A research framework for the development and implementation of interventions preventing work-related musculoskeletal disorders (2017) by van der Beek AJ, Dennerlein JT, Huysmans MA, Mathiassen SE, Burdorf A, van Mechelen W, van Dieën JH, Frings-Dresen MHW, Holtermann A, Janwantanakul P, van der Molen HF, Rempel D, Straker L, Walker-Bone K, Coenen P https://www.ncbi.nlm.nih.gov/pubmed/28945263

5 Analysis of Manulife’s disability claims from January 1st to October 31, 2017

6 Waiting your turn, Waiting times for HealthCare in Canada by Bacchus Barua, Fraser Institute (2017), https://www.fraserinstitute.org/sites/default/files/waiting-your-turn-2017.pdf

7 2017 Medical Confidence statistics

Lifemark Health Corp. is a Canadian company, providing healthcare solutions to Canadians since 1998. Medical Confidence is a privately owned Canadian company found in 2009 whose mission is to empower consumers of the Canadian healthcare system. Medical Confidence is a trademark of Medical Confidence Inc.

Home

We’re constantly improving the online claims experience for your plan members!

-

We’re well on the road to delivering the best plan member experience in the industry. And it’s a journey that will never end!

The latest improvements:

- Choose from an expanded list of service provider types. Fewer details to key means a faster and easier claim process.

- Submit estimates online. Especially useful to anyone who needs to claim for a medical device.

- Faster online claims. Submit all your claims online, for the fastest way to get your money back.

We’re listening and using your valuable feedback to create the best claims experience possible. And it’s just going to keep getting better! Stay tuned for news of future updates.

Home

Controlled, caring support for members who need medical marijuana

-

We’ve teamed up with Shoppers Drug Mart Corporation to deliver a medical marijuana program that gives you a controlled, responsible and caring way to support your members who are suffering from chronic pain, discomfort and other serious ailments.

Guidance from Shoppers Drug Mart Health Care Professionals

Through our unique partnership, specially trained pharmacists at the Shoppers Drug Mart patient care centre will offer your plan members, who have been approved for medical marijuana coverage, the guidance they need to have confidence in their choice of treatment. They will advise on the different strains of medical marijuana and the different ways to take it. Based on this support, plan members can choose the treatment that best meets their needs and is covered under their benefits plan.

Members will get ongoing case management from Shoppers Drug Mart’s patient care centre, tailored to fit their individual needs. They’ll have access to education, regular check-ins, counselling, and phone and email support. Online billing support is also coming soon. When it’s available, members won’t have to pay up-front for medical marijuana expenses that are covered through the program.

Supporting the needs of both you and your members

We’ll provide claims controls. Any request for coverage will go through our prior authorization process. This helps you know certain criteria have been met before the drug is approved for coverage.

Doctors may recommend medical marijuana for a variety of reasons. Our program approval process is based on covering conditions where evidence supports its use, including

- stiffness and involuntary muscle spasms in patients suffering from Multiple Sclerosis,

- nausea and vomiting in patients undergoing chemotherapy, and

- chronic neuropathic pain.

The medical industry is still learning about potential uses for medical marijuana. The list of conditions it can help may change in the future.

Approved claims will be covered as a drug benefit – and we’ll work with you to set coverage limits that work for both you and your members.

We’ll also give you information to help you make informed policy decisions about medical marijuana in the workplace.

Available to add to your plan now

You can choose to make the medical marijuana program available to your plan members by adding it to your benefits plan. It’s available to you now.

The program will be available to members of participating plans starting in September.

Talk to your Manulife representative for more information, or to add the program to your benefits plan.

In the meantime, read the FAQ, which includes with more information about medical marijuana, Health Canada’s Access to Cannabis for Medical Purposes Regulations, and our medical marijuana program.

Home

Clear communications make it easy to see the benefits of benefits

-

We’re on a journey to change how we communicate. Over the past few months, we’ve been creating a better experience through words, pictures and design, so that plan members can find the information they need, understand it, and use it.

We considered many factors when deciding to make this shift:

- With the adoption of digital media, reading habits have changed: people scan, and they use simpler words.

- We need our content to be accessible to everyone.

- How we can reduce questions to you, plan sponsors, and our contact centre.

- How we can reduce questions to you, plan sponsors, and our contact centre.

- The understanding of financial jargon is low.

There are lots of communications to consolidate or update, so it will take time. But we’re off to a great start. We’ve already released website content, letters and forms that follow our new approach. It just makes sense to ensure our communications are easier to understand.

-

Home

Your claim has been received...

-

Your plan members are now receiving e-mail* confirmation from Manulife when their claims enter the system.

The new process gives plan members written confirmation that their claims are being worked on. The process applies to claims submitted by paper. Plan members using paper also receive information on the electronic services available to them – so they can choose the options that best match the way they live their lives.

End to end messages - “Your claim has been paid.”

Plan members will have more information available to them when their claims have been processed and paid. A new, expanded e-mail confirmation note includes additional information:

- The patient’s first name

- Benefit type

- Date of service

- Amount submitted

- Amount paid

It’s virtually an explanation of benefits, while still protecting the plan member’s privacy.

Coming soon – “A claim has been submitted by your pharmacy”

For claims processed at the pharmacy – plan members will receive an e-mail informing them that a claim was submitted on their behalf by their pharmacist. Plan members will then be able to review the claim details on the plan member site, adding another layer of oversight. This new pharmacy claim e-mail will be triggered 2 to 3 days after the prescription is filled – the normal time required to process a drug claim.

No need to worry. No need to call

With written confirmation, plan members can be confident that their claims were processed and paid – no need to worry, call, or check the website.

We continue to work on other ways to make the claims process easier. We’re developing additional tools that will help plan members track their claims closer as they journey from “claims made” to “claims paid.”

*applies to plan members who have provided Manulife with a valid e-mail address.

Home

Quebec RAMQ out-of-pocket maximum increases

-

Plan sponsors with plan members who reside in Quebec must offer prescription drug coverage that meets the minimum legislative requirements set by the Régie de l’assurance maladie du Québec (RAMQ).

On July 1, 2018, the following changes were applied to private plans as announced by RAMQ:

- The maximum annual out-of-pocket drug expenses that plan members are required to pay increased from $1,066 to $1,087.

- The plan member’s co-insurance level (maximum out-of-pocket expenses) increased from 34.8% to 34.9% of the prescription cost.

On January 1, 2019, the maximum coverage for Quebec smoking cessation products will increase from $700 to $800.

Quebec's drug plan legislation requires that private drug plans are at a minimum equal to the drug coverage provided by the RAMQ. As such, all drug plans covering Quebec plan members must provide coverage for smoking cessation products that are listed on the RAMQ Formulary.

Manulife will not automatically update applicable contracts to reflect the RAMQ July 1 out-of-pocket expense increases. If your contract duplicates coverage provided by RAMQ, and reads an annual out-of-pocket expense of $1,066, you must submit an amendment to your account executive requesting that your contract be updated to match RAMQ's 2018-2019 minimum requirements.

Contracts that do not state a specific dollar out-of-pocket amount do not require updating.

Home

Ontario Human Rights Tribunal ruling

-

A case between an employee and employer was recently brought before the Ontario Human Rights Tribunal.

The case related to the termination of health, dental and life insurance group benefits at age 65.

In an interim decision issued on May 18, 2018, based on the evidence presented, the Tribunal ruled that the provision of the Ontario Human Rights Code which permits employers to cease benefit coverage at age 65 is unconstitutional. The provision violates the equality rights in the Canadian Charter of Rights and Freedoms.

It is unknown if there will be an appeal on the decision. If there is no appeal, the parties have until early July to agree to mediations or return for a hearing on the tribunal ruling.

Manulife is reviewing the specifics of this decision. We will continue to monitor this matter closely and provide updates as they become available.

Questions?

Please contact your Manulife Representative.

Home

An update on Saskatchewan PST

-

On February 26, 2018, Saskatchewan’s premier, Scott Moe, announced he was reinstating the Provincial Sales Tax (PST) exemption for individual and group life and health insurance products. This also applies to Administrative Services Only (ASO) arrangements.

If this legislation applied to you…

For plan sponsors who receive a monthly bill from Manulife and ASO arrangements

The Saskatchewan PST has now been removed from all bills.

We’re crediting accounts for the relevant tax payments you’ve made since August 1, 2017 – the day the PST charges first became effective. Credits for active customers will be completed by early June.

If you are an AdminAdvantage™ client and receive a payroll file, you will see this change in your payroll data by the end of May.

For Third Party Administrators and Self-administered plan sponsors who submit their bill to Manulife

If you prepare your own bills and have not stopped submitting Saskatchewan PST with your payments, you can do that now. If you haven’t already done so, adjust your next bill by the amount of your Saskatchewan PST credit.

Background

On August 1, 2017, Saskatchewan started charging 6% PST on individual and group life and health insurance products. At that time Manulife Group Benefits, plan sponsors, and third-party administrators with plan members in Saskatchewan made system changes to collect and remit the required PST.

On February 26, 2018, the decision to charge PST on these products was reversed by the premier of Saskatchewan.

If you have questions, speak with your Manulife representative.

Home

Online reporting

-

You now have access to 13 new reports directly from the plan administrator site. Previously available by request only from your Manulife representative, you will now be able to access them when it’s convenient for you. The reports you now have access to online are:

- Top Drug Ranking Report by DIN

- Top Drug Ranking Report by Active Ingredient Report

- Most Common Indication Report

- Top Pharmacy Provider Ranking Report

- Specialty Drug Claims Summary Report

- Brand versus Generic Claims Summary Report

- Claims by Dollar Range Report

- Claims by Age Range Report

- Claims by Submission Type Report

- Claims Service Detail

- Pooled Claims Report

- Utilization Report

- Recurrent Claims Report

Why we’re excited to promote these reports

Having these reports available directly from the plan administrator site means more reporting capabilities at your fingertips. With the addition of these reports you’ll also benefit from these added features:

- Available in Excel format

- Built in benchmarking that lets you compare your plan to Manulife’s overall block of business

- Available in English and French

- Flexibility of requesting reports for individual divisions/ policy numbers or consolidated across multiple divisions and contracts

As part of this project, we’ve looked at the online reporting library and have made the decision to remove some reports. The reports we removed either are outdated or have been replaced by one of the new reports. You can find a full list of these reports here. If you previously had a report scheduled to run on a certain date or time, you’ll need to set it up again.

Home

Hello. ¡Hola! Ciao! Namasté. Talking to us just got easier!

-

We’ve partnered with LanguageLine Solutions® to offer your group benefit plan members the convenience of talking to us in over 150 languages. At no cost to you or your members, this new partnership gives us access to a team of nearly 9,000 professional interpreters that know and understand our business.

How it works?

It’s simple. A member calls in to our Customer Service Centre. They’re looking for information on their group benefits plan, but, English or French isn’t the language they’re most comfortable speaking. All they do is let the customer service representative know and they’ll conference in an interpreter to help.

Understanding and getting answers to questions about their benefits plan is now a lot easier. Spread the news. Here’s an email you can to send out to your members.

Need more information? Get in touch with your Manulife representative.

Home

Pharmacogenetics testing program is now underway

-

An innovative pilot program is underway with a limited number of clients that aims to help plan members (on disability or actively at work) with depression, pain or anxiety, to speed up their treatment.

Pharmacogenetic testing can help determine how genes can positively or negatively affect a person's response to drugs. The results of the test offered through this pilot can help physicians prescribe the most effective medication more quickly. This may lead to better health outcomes, reduce the suffering of plan members and avoid several trial-and-error treatments with potentially adverse side effects.

The pilot, being conducted in coordination with BiogeniQ, will allow us to gather plan members’ experiences and feedback, and evaluate the impact of these tests on group benefits plan. Plan member’s personal results will be kept confidential. We expect the pilot evaluation to be complete in 2019. Stay tuned for future updates on the pilot’s progress and results.

Home

Manage your team's admin rights to your account – online

-

You can now manage administrator access to your account yourself. No more paper requests! One key plan administrator can add and update other administrators, giving you better and faster control of your account.

Identify your main administrator and get started. Here are the instructions.

Home

Prices for almost 70 generic drugs dropped 25-40%

-

On April 1, 2018, the prices on the ingredient cost for almost 70 of the most common generic drugs dropped 25-40%. These drugs include those used to treat high blood pressure, high cholesterol and depression – and are used collectively by millions of Canadians.

The discounts are based on an agreement between the pan-Canadian Pharmaceutical Alliance (pCPA) – which represents provinces, territories and federal government – and the Canadian Generic Pharmaceutical Association (CGPA). Under the new agreement, provincial and territorial governments agreed not to pursue tendering for participating drug plans over the five-year term.

Why this is important

The price drop applies to both public and private plans. Public plans, plan sponsors and their plan members and those that pay themselves stand to save money.

Private plans with generic substitution stand to offer even greater savings

Plans with generic substitution help manage drug costs by reimbursing lower priced generic drugs and brand name drugs that don’t have a generic equivalent.

Plan sponsors looking for ways to manage their drug plan may want to look at applying generic substitution. For these plans, since pharmacists typically offer a generic drug when it is identified as interchangeable by the province, the plan member experiences minimal disruption.

What we’re doing

- Commencing with the August renewals, EHC premiums/deposits will reflect a 1.5% reduction.

- There will be no off-renewal adjustments.

Questions?

Please contact your Manulife representative.

Home

Trusted provider network pilot

-

As part of our year-round commitment to protecting you from group benefits fraud, an innovative trusted providers program is being piloted. By supporting plan members to be smart consumers, we can work together to prevent fraud and continue our mission to provide the best group benefits experience in the industry.

How it works

Providers involved in the pilot, can apply to be featured on the trusted providers network list. Once the applications have been reviewed by the team, they are rigorously audited to ensure they meet the required standard of business practice and service expectation. Once the provider has been identified as ‘trusted’ they are added to the trusted providers network list.

How it benefits customers

The main objective of this pilot is to significantly reduce the risk of fraud against group benefits health plans, by partnering with reputable providers and establishing an additional level of security to prevent and detect provider fraud.

How it benefits plan members

By validating the provider prior to claim submission, the process is made more secure and efficient, further improving the plan member experience, when choosing to be treated by a provider from the trusted providers network list.

How it benefits providers

By being featured on the trusted providers network list, the provider gains a marketing advantage, having been identified as having high standards of professionalism, integrity and business practice.

The trusted providers network program is currently being piloted in London, Ontario and we expect to have the results of this pilot later in the year. Stay tuned for updates!

-

Report Fraud Now

If you suspect benefits fraud, report your concerns to shareandprotect@manulife.ca or call our confidential tip line 1-877-481-9171.

If you have any questions or would like any further information, please contact your Manulife representative.

Home

Diabetes Wellness Program pilot has now launched!

-

An innovative pilot program is underway that aims to help eligible plan members with diabetes manage their condition. The program has been developed to:

- Help plan members better understand their diabetes and make positive lifestyle choices that maximize long-term health and wellness

- Help mitigate the risks associated with diabetes and their impact on members’ quality of life and work

Eligible plan members will benefit from timely personalized support and coaching ‒ from Certified Diabetes Educators, pharmacists, online resources, and the latest blood glucose monitoring tools. The goal is to enhance health outcomes through better lifestyle habits and glycemic (blood sugar) control. Members will also be advised about opportunities to optimize their medication therapy, including more effective drugs and lower-cost alternatives.

The pilot, being conducted in coordination with Express Scripts Canada (ESC) and ProHealth, will allow us to gather plan members’ experiences and feedback, which will help shape the future of the program. We expect the pilot evaluation to be complete in early 2019. Stay tuned for future updates on the pilot’s progress and results.

Home

Enhanced Private Duty Nursing Experience

-

Manulife is partnering with Bayshore Home Health (Bayshore) to help members get enhanced guidance and support for their Private Duty Nursing (PDN) needs—when they need it most. A Bayshore registered nurse will provide a free telephone assessment to determine the member’s nursing needs. Members will be able to feel confident knowing that they and their loved ones are receiving the proper care they deserve.

Bayshore is a Canadian-owned premier healthcare provider with over 50 years’ experience. They are a trusted expert in handling and assessing PDN situations.

How it works -

After a member contacts Manulife and provides consent, a registered nurse will call them to obtain all required medical information. The registered nurse will also help to navigate the healthcare system and offer guidance and support in accessing additional funding through government services and programs that may be available to help members maximize their benefits.

Although there is no obligation for members to have the nursing services provided by Bayshore, Manulife has negotiated preferred pricing with Bayshore to help benefit dollars go even further.

For more information contact your Manulife representative.

Home