Home

Looking back on a year of change

-

We made great progress on our transformation journey this year, with the aim of giving you and your members the best digital experience in the industry. Check out these digital updates that mean big positive changes for your members.

Healthcare Online: A digital doctor’s office whenever you need it

Our goal is to help members be healthier and make your organization stronger. That’s a lot easier when members can access healthcare just by picking up a smartphone.

With Healthcare Online, members can use mobile apps or just jump online to skip the waiting room.

Members can connect 24/7 to doctors and nurses who will give advice, prescribe and renew existing prescriptions, and even refer to specialists.

And that helps organizations like yours. A Canadian study1 showed that 8 out of 10 patients who had an online physician visit avoided work absences.

Healthcare Online is flexible. You can offer it as part of your benefits package or simply give employees access to preferred pricing.

Contact your Manulife representative to learn more.

1Virtual Visits in British Columbia: 2015 Patients Survey and Physician Interview Study

Goodbye cheques. Hello direct deposit!

We want members to understand the benefits of submitting their claims online and opting to have their claims payments reimbursed by direct deposit:

- Saying “Goodbye” to cheques, means less waiting, less paperwork and trips to the bank!

- Saying “Hello” to direct deposit means getting claim money paid right into a bank account. It’s fast and secure!

- Submitting all claims online allows members to get their claims processed as quickly as possible. Manulife Mobile gives members the added freedom of submitting and managing their claims on the go.

Take a look at some of our other stories from this year

A new approach to opioid management

The Wellness Report - meaningful insights to make decisions easier and lives better

Home

What you should know and expect when travelling outside Canada

-

When travelling internationally, unexpected events can happen. Everything from extreme weather and political unrest to disease epidemics can potentially spoil your trip. If you’re thinking about booking your winter travel, it’s important to prepare yourself with as much information about your destination as you can.

We want to help make sure you have a safe and happy trip, so we have some tips to share – especially if you are travelling outside of Canada.

Read the brochure for more details about Winter Travel Planning

Home

Student coverage – Fall reminder

-

It’s time to make sure that any over-age student status are up-to-date so there isn’t any interruption in their coverage.

How to do so?

Plan members need to complete the Request for Over-age Dependant Coverage form available on the Plan member secure site.

Who is eligible?

An over-age student is a plan member’s unmarried child who falls within the designated age range, as defined by your plan, and is a full-time student in a post-secondary accredited program.

When the over-age student leaves school or no longer qualifies as an eligible dependant, plan members need to notify us by completing the Termination of Over-Age Dependant Coverage form.

Note for Quebec over-age students

If a Quebec over-age student is no longer eligible to your plan, it is your obligation to notify him or her and let them know they must apply to the Régie de l’assurance maladie du Québec (RAMQ).

For any questions, please contact your Manulife Representative.

Home

The Future of Manulife is Digital

November 8, 2019-

We want your members to have the easiest, simplest experience when engaging with their health benefits.

We have a few tools and features that will help:

- Mobile App

Our Mobile team just released an update for Apple iOS users that allows them to check their spending account balances (Health Care Spending Account, Wellness) from the Manulife Mobile app – one of the most popular requests from members! - Improved Digital Member Experience

With access to our member portal, your members can easily submit online claims, get instant status updates on claims and available balances. And they’ll get their money back in their bank account so much faster. - Healthcare Online

Access to quality healthcare at their fingertips. Your members will get 24/7 online access to Canadian healthcare providers to diagnose and treat their health concerns. These professionals give advice, prescribe and renew existing prescriptions, write labs and imaging requisitions, and even refer to specialists and allied health professionals.

Setting your members up for the easiest, simplest experience:

Your members will now be asked to enter their email and banking information on the plan member site if they haven’t yet. It’s a sure way of getting them signed up for direct deposit.

Why should your members use direct deposit?

- Their claims process is faster and easier

- Their claims payment only goes in

- They can use the App for everything once they’re set up

- They get their back money faster

We’ve put together extra tools to support your members through this upgrade. Share them as needed!

- Mobile App

Home

Claims is going digital!

September 6, 2019-

Group Benefits is making a big commitment to Manulife’s Bold Ambition to become the most digital, customer-centric global company in our industry. These changes are being made alongside our goal to be the most digital, customer-centric company in our industry.

Starting this September, we are transitioning all members (new and existing) to a digital claims process and asking them to provide us with their email address and banking information. We want to have 100% of our plan members’ email addresses and bank accounts on file by year end, and currently we are missing information from + 1,000,000 members.

Being ‘digital’ is simply the way we want to serve our customers. Our change in approach accelerates our transformation to digital getting our new plan members and our existing ones on board so they too can enjoy the speed and convenience of direct deposit and emailed claims notifications.

Thank you for helping us on our mission to become the best in our industry!

Click here to find out more and register online!

Home

There’s more to back-to-school than a new laptop and textbooks

August 12, 2019-

Back-to-school season always seems to end up being a race to gather supplies for the first day of class. But we want to remind you that there’s more to it than that. Help make sure the students in your life also get what they need outside the classroom.

Your child may be excited about their first university experiences, but what if that includes a cracked pair of glasses from an intense activity during orientation week? Will your group benefits cover a visit to the optometrist and a new pair of glasses?

If your child has reached the age when they’re considered an adult under your plan, you’ll need to make sure they’re listed as a full-time student to continue their coverage. It’s a quick and easy status update on our member secure site.

Of course, they could be chasing other passions instead of going to school this year. You can still get them health benefits for unexpected events in their lives. Manulife’s CoverMe® plans are easy to understand and manage. These plans can cover everything from emergency medical care to eye exams.

No matter what your child is pursuing this back-to-school season, make sure they’re covered with Manulife.

Home

Your members can get their claim money as soon as the next business day!

-

Forget the delays and hassle of sending in paper claims. Your members can benefit from the speed and convenience of online claims by signing up for our secure site or Manulife mobile app.

They can even submit their claims as they’re wrapping up their appointment. It’s as simple as a few clicks and, if necessary attaching a photo of their receipt, and they’re good to go.

Plus, the money can be in their account as soon as the next business day, if they sign up for direct deposit.

It’s all part of our digital shift to make the member experience quick and easy - making their lives better and the organizations they work for healthier.

Home

Committed to your members' digital experience - our journey continues

-

The world is changing. Information is shared instantly, people stay connected even when they’re in different countries, and they’re taking actions online that have more and more impact in the physical world. The digital transformation continues, and Manulife is leading the way.

Members’ interactions with us should be simple and intuitive. They juggle a lot in their lives – work, family, friends, leisure, and health – so managing their group benefits plan should be easy and worry-free.

Over the past months, your plan members will have noticed little enhancements to their digital plan member experience. Enhancements like the new online chat feature on our public site, which quickly answers general questions, on-the-go (currently only available in English). These little changes add up to one big improvement: empowering your plan members to help make their lives better. Easier access to all the tools and resources they need will help them make decisions through all the stages in their lives.

From first signing up to the secure member site and entering their new plan member information - submitting their first claim, receiving their explanation of benefits online, then getting their money paid into their account, all within a few days – it’s simple, fast and convenient. And, it’s our commitment to your plan members to give them a digital experience that will have a positive and lasting impact in their day-to-day lives.

In the works

- Visual-based response system option when calling customer services from a mobile phone - fast answers to popular plan-related questions, without spending time on hold – launching summer 2019

- Enhanced option to update personal and family information, such as address change, through the Member Profile tab – due to launch fall 2019

- Many others exciting features that will help quickly answer their plan-related questions and manage their benefits on-the-go

Keep checking our Discover Hub and Advance Hub for all the latest updates, and remind your plan members to sign up for the secure site.

The digital transformation has already begun, so let’s all be a part of it!

Home

No extra plan costs for you? No detailed medical questions for your members? It’s the perfect time to consider Personal Life.

-

You want to offer more benefit options to your members. You’re also under pressure to keep your costs and administrative efforts in check. It’s a challenge to do both! But we’re here to help – with enhancements to our Personal Life offering.

We’re making it easier - with Personal Life

Did you know only 16% of Canadians say they’ve bought enough life insurance to cover their remaining mortgage payments if they die?1 Providing easier access to life insurance is a solution to help your members address the gap. It can have a true impact in their lives.

Personal Life is a great option! It’s a voluntary benefit that helps members get life insurance coverage beyond the basic coverage available through their plan. It’s flexible for your members and it offers an easier way for you to add value to your plan. And with our current enhancement we’ve made it even easier for members to get the life insurance they need. Check out ‘What’s new?’ for more information.

Advantages for you Advantages for your members What’s new? You can give your members access to affordable, portable life insurance with - no administration

-

no payroll deductions to coordinate

- the member is billed directly by Manulife

- the contract is with the plan member

- no extra cost to add it to your benefits plan

- Flexibility -- coverage is portable, so it travels with them, even if they change jobs

- Choice -- they choose the amount of coverage that’s right for them

- units of $25,000 available for members and their spouse, up to a maximum of $500,000

- a flat $20,000 is available for eligible children under age 21

- Convenience – members set up pre-authorized payment for monthly premiums by credit card or banking

- Living Benefit -- a one-time advance payment of 50% up to a maximum of $50,000, if they or their spouse become terminally ill

- Members have access to more coverage with NO need to provide medical details*

- up to $100,000 for themselves and $50,000 for their spouse**

- Competitive rates

When is it available?

If you’d like to add Personal Life

Talk with your representative at The Manufacturers Life Insurance Company (“Manulife”) to get started.If you currently offer Personal Life

If you currently offer Personal Life through your benefits plan, your plan will automatically move to the enhanced offering during your next renewal. We’ll let you know more about how the change will happen when we get closer to the date. Stay tuned for more information!Do you have questions?

Give your Manulife representative a call! We’re here to help.

*A 24-month pre-existing condition clause still applies for coverage that has been purchased without providing detailed medical information (amount up to $100,000 for members and $50,000 for their spouse).

** Coverage for children hasn’t changed. Our standard is a flat $20,000 in coverage for each child with no medical details needed.

i Source: https://www.insurancebusinessmag.com/ca/news/breaking-news/most-canadians-are-underinsured-study-62245.aspx, 2017.

Home

Taking the next step in plan member experience

-

New features have been added to the plan member secure site.

On the landing page:

- Members can now view their online claim submission status, the type of claim it was for as well as who the claim was for.

- The number of claims a member can see has increased from 5 to up to 50.

- Members can directly contact the Manulife Group Benefits Client Contact Centre regarding a specific claim

Improved audit process

Direct from the plan member secure site landing page:

- Members can now submit the documents requested for the audit

- Members can communicate directly with the Manulife Audit team to ask for clarifications

Home

Enhanced Disability communications – creating better outcomes

-

Recently, we told you how Manulife is changing its messages to make them easier to understand and act on. We’ve taken another big, bold step. We’ve completely transformed the letters we use in our disability area. Our new messages make great use of photos, graphics, charts, colour and modern formatting. The letters use proven scientific insights into human behavior to convey messages that will help motivate members in their journey to recovery. Plan members and sponsors will start seeing them very soon.

Home

Bigger & Better Benefits with Banking

-

We believe with the right resources, employees can lead happier, healthier lives – and when they do, organizations become stronger and healthier too. That’s why we’ve partnered with Manulife Bank to revolutionize our benefits.

Exclusive bank offers that can help put more than $3,000 back in plan members’ pockets in the first year!*

Manulife Bank’s all-in-one solutions are simple and flexible. No more hidden fees, misleading offers or superficial rewards. Your plan members could get value they may not be experiencing with their bank today.

-

-

Manulife Bank’s Advantage Account – High interest & free unlimited banking*

Canada’s most useful savings account according to the Globe and Mail, it combines chequing and savings with no monthly feeSPECIAL OFFER FOR PLAN MEMBERS: Always receive our highest promotional interest rate (3.35%, subject to change)

-

Manulife One all-in-one mortgage, daily banking and line of credit*

Can help save thousands in interest and be debt free soonerSPECIAL OFFER FOR PLAN MEMBERS: $1,000 cash back after the account has funded

-

ManulifeMONEY+TM Visa† cash back credit cards*

Plan members can accelerate their cash back rewards on groceries and everyday spend

Available for all your group benefits plan members

Access to these exclusive bank offers requires no work on your part, and we’ve developed a simple and engaging experience for your plan members. We’ve posted a banner on the homepage of the plan member secure site and a simple click will take them to more information. It’s that easy.Questions?

Talk to your Manulife Representative to learn more about our exclusive bank offers.* Some terms and conditions apply.

†Trademark of Visa International Service Association and used under licence.

-

Home

Supporting plan members through critical life moments

-

We recently asked plan members to help us identify moments in life that cause them the most financial and emotional stress. In total we’ve identified 18.

Here’s what they had to say:

-

- Birth of a child

- Child comes of age

- Overage dependent

- Joining of families

- New job

- Leaving a job

- Marriage/partnership

-

- Critical illness/ injury

- Retirement

- Receiving an inheritance

- Life policy maturing

- Buying your first home

- Paying off your mortgage

- Divorce

-

- Death of a loved one

- Bankruptcy

- Transition to long term care

- Living through a disaster or catastrophe

-

We wanted to do something to help them alleviate some of this stress. As a result, the Life Moments team was born.

What does this mean to plan members?

No more having to call multiple numbers during these sometimes-difficult times. The Life Moments team, will serve as a single point of contact.

18 life moments are a lot! So, we’ve decided to tackle these one at a time, starting with the death of a loved one. When the Life Moments team gets a call to notify them of the passing of a plan member, they’ll run a search for other possible products the member might have with Manulife. Once they have all the information they need, they’ll coordinate all necessary notifications across the organization on behalf of the caller and get the claims process started. We want to make this time as easy as possible for members and having a single point of contact, is a step in the right direction.

Over the next couple of months, we’ll look to help members with additional life moments.

If you have any questions, reach out to your Manulife Representative.

Home

Our spending accounts just got more flexible and affordable

-

In today’s workplace, employees want more flexibility and choice especially when it comes to their health benefits. With our enhanced Health Care Spending Account (HCSA) and Lifestyle Spending Account (formerly known as our Taxable Spending Account), you can give your plan members more choice to spend their benefits dollars in a way that’s best for them, while you can better control your plan costs.

With our enhanced Heath Care Spending Account (HCSA), you can:

- Enjoy competitive HCSA administration fees

- Cover dental expenses through an HCSA if you don’t have a dental plan

- Carve out non-catastrophic health expenses (hospital, paramedical, vision, and medical supplies) and cover them through an HCSA

- Add the option for members to submit claims directly to their HCSA, instead of submitting to the core or Coordination of Benefits plans first (now available to groups of all sizes)

NEW - Our Lifestyle Spending Account (LSA) is now available to all clients and administrative fees are much more competitive

The advantages of offering Spending Accounts

By offering an HCSA and/or LSA, you can boost your group benefits plan by providing coverage flexibility and choice that will help attract and retain employees.

An HCSA is a tax-deductible expense for your company and provides plan members with tax-free coverage of expenses normally associated with a health and dental benefits plan.

A Lifestyle Spending Account is taxable benefit for plan members that can help support their overall well-being and reduce workplace absenteeism. Things such as gym memberships, child and pet care expenses, and public transit passes are just a few examples of eligible expenses.

Submitting HSCA/LSA claims can be done online or using the mobile app, which makes the process quick and easy for your members.

If you want to know more about our enhanced Spending Accounts, contact your representative at The Manufacturers Life Insurance Company (Manulife).

Home

Benefits fraud: turns out, prevention is the key.

-

When it comes to your benefits plan, keeping costs down is a priority. And stopping any misuse and abuse of it is critical. That’s why we’re doing something different. It’s time to think about prevention first. So, what does this look like?

Engaged members

Your plan members are key. Why not engage them through information and empower them to be part of the solution. A refreshed site makes this easy to do. Ready-to-use campaigns can help your members to make smart decisions and practice good claims behaviour so they don’t put your plan at risk.

When your members see suspicious claims, they can use the new Share and Protect e-form. It’s an easy and confidential way for your members to tell us about it, so we can look into it.

Trusted relationships

We’ve launched a Trusted Provider Network pilot to help you and your members work with professional and ethical service providers. It’s early, but we’re already seeing very positive results. And rest assured, when suspicious claims are made, our dedicated team of experts, with state of the art analytics systems, are on the case.

This is just the beginning of our new approach to protecting your plan. There’s so much more on the horizon. Stay tuned!

Home

Leading a new age of claims – one year in

-

Manulife plan members were the first in Canada to be able to file every claim online! Since we launched, members have submitted over 5 million claims online.

Over a million of those online claims were through a mobile device. People use their phones to do just about everything these days – add to that submitting their group benefit claims.

Claims in the palm of their hand

A year ago, we also launched a new convenient app that is fast and easy to use.

“Let’s me see my benefits, past claims and other useful info. Also, lets me submit a claim via the app.”

- Brian Sharp (Google Play Store)Here are other ways we continue to improve our members’ online experience:

- Apple Touch ID and Face ID®

- AndroidTM Fingerprint ID

- Access Benefits card and load to mobile wallet

- Benefits balance via Smart Home Technology

If you have questions, call your Manulife representative.

(Source: Google Analytics and Adobe Analytics)

Home

Help your members turn the page on their next chapter

-

Starting a new chapter in life can bring a lot of change. Whether they’re retiring, or taking on their next challenge, members who are leaving your group plan will have important decisions to make about their ongoing benefits needs. Having the option to buy coverage through My Next Chapter can help them make the transition.

Through My Next Chapter, Manulife helps members who are leaving your group plan at any stage of life learn about our FollowMe™ and Flexcare® programs. They’ll get information on the different individual health and dental options available to them. More than 10 different plan combinations are offered to meet their needs.

It’s an easy and convenient transition solution, offered at no cost for your organization.

How My Next Chapter works

- Easy administration – we’ll connect with members who are leaving your plan directly, using the member data we have on file. We’ll answer their questions and take care of next steps.

- Mailings will go out to members who are retiring, or otherwise leaving your organization.

- In the mailing, members will get a letter and promotional materials, telling them about FollowMe and Flexcare – our products designed for individual coverage. These products can provide similar benefits to their group plan coverage.

- We’ll also invite employees to visit MyNextChapter.ca or call the toll-free number (1-844-732-4237) to talk to a Licensed Insurance Advisor. Through either channel, they can learn more about their available options, get a quote, or buy the solution that best meets their needs.

- Members who are leaving your group plan may have access to exclusive offers:

- 5% savings on the FollowMe Health rates if they pay their premiums via credit card or pre-authorized debit

- Additional Accidental Death and Dismemberment insurance

- Guaranteed acceptance*, when they apply within 120 days of their group coverage ending

For more information about My Next Chapter, please contact your Manulife representative.

*Guaranteed acceptance dependent upon receipt of the first premium payment and satisfaction of eligibility criteria.

For Quebec residents only: to be eligible for a FollowMe or Flexcare plan, Quebec residents must also have RAMQ prescription drug coverage.

Home

Online member services are getting a whole lot easier!

-

Earlier this year we told you about some exciting enhancements we’re working on to make online services easier and more personalized for your plan members. And we promised we’d keep you updated on our progress.

Simple to join and sign in to www.manulife.ca/signin

No more struggling to remember their plan contract number or certificate number – your plan members will be able to sign in using a personal email address and a password they create. Plus, recover or reset their password in real-time. This enhancement will launch in early 2019.

Choosing online benefits

We’re also improving how your plan members choose their benefits online. Starting with new AdminAdvantage™ groups, they’ll soon have a fresh and simple way to manage their benefits and get the most from their coverage.

Stay tuned for updates on these new features, and more!

-

Home

Two new ways to access your benefits!

-

Your members have a good reason to smile – because facial recognition is just one of the ways we’re creating a better benefits experience:

- Face ID® - will allow users to use facial recognition to access the Manulife Mobile app through an iPhone X. Making access easier, more convenient and in sync with modern experiences. Watch the video to learn how to access Manulife Mobile using facial recognition on iPhone X.

- Mobile wallet - members can now add their benefits card to Apple wallet and Android WalletPasses-compatible applications.

Here are other ways you can access and interact with your benefits plan:

-

-

Home

Smart Home Technology

-

Plan members can interact with their benefits plan using Smart Home Technology! As a first step into the area of Smart Home Technology, we worked with Amazon on the launch of Alexa, a cloud-based voice activated service. Check out the video to see how it works!

Initially, Amazon will be launching Alexa in English only. When Amazon launches Alexa in French, we will be ready.

Based on the current Manulife Mobile available balances feature, plan members can interact with their Group Benefits plan through Alexa using only their voice. Users will be required to authenticate their account prior to gaining access to any information.

We are focused on improving the member experience at every touchpoint. You can expect to see a lot more innovations in the space of customer experience and usability.

For more information, reach out to your Manulife representative.

-

Home

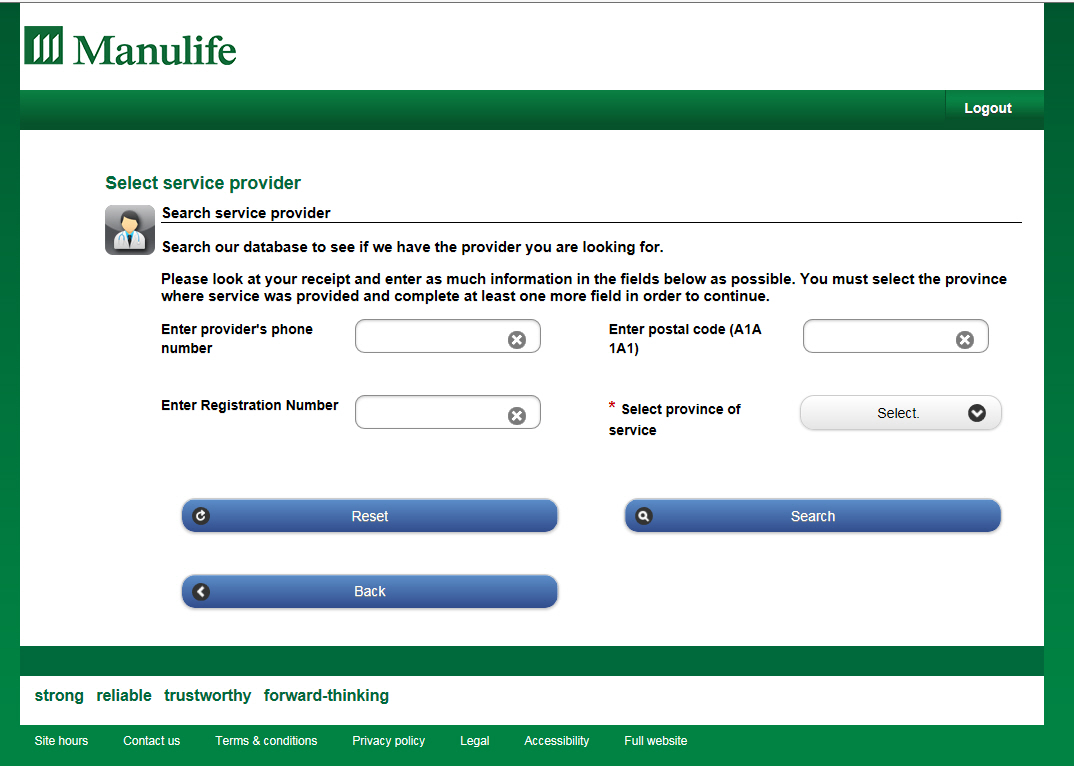

New search for service provider feature!

-

We upgraded upgraded our online claims tool with great new features. When we add new features to enhance our members’ online experience, some saved information, like service providers, may need to be filled out again. The new search for service provider feature makes adding a provider quicker and easier for our members.

Using search for service provider, members only need to fill out two pieces of information to find their provider fast!

Home

Health benefits designed for the way plan members live their lives

-

If life is a juggling act, we've just given plan members an extra set of hands.

The days of expecting plan members to fill out forms or wait for a cheque to come in the mail are over. Smartphones and other technologies have changed the way people do things. They want to interact when and where it's convenient for them, so we've made it easier than ever for plan members to get the most out of their group benefits plan.

Check out the member tools we’ve developed below. Or, watch the video to learn more.

Whether a member prefers to manage their benefits on the go or at home, it's easy to use the Manulife Mobile app or secure website to:

- Find out how much they have left to spend - before they make an appointment.

- Check whether the drug their doctor suggests is covered under their plan while they're still in the doctor's office - avoiding extra calls and visits.

- Submit ANY type of claim, at any time, and get their money back fast!

-

Home

Provider eClaims

-

We’ve simplified our Provider eClaims process

Our plan members and providers have told us that our eClaims process needed simplifying. We are pleased to announce we’ve done just that.

What’s changed?

Plan members no longer need to be registered for direct deposit, electronic claims statements and the plan member secure site before being eligible to submit eClaims directly through their providers. Just another example of how we’re continually creating a better benefits experience.

Home

Submitting life claims is easier than ever

-

Family members can electronically submit proof of death documents, wills and other documents needed to process a life claim.

For those members who were on approved long-term disability or life waiver prior to their death, proof of death documents will not be required.

There will be some exceptions for not having to provide original documents. We will work with the families at that time to get the claim processed as efficiently as possible.

-

Home

Submit All claims online!

-

Online claims just got easier. Plan members can take advantage of two features when submitting group benefit claims.

Members can simply select “Other” under Service provider type to submit claims not previously accepted online. They will never have to reach for a paper health and dental claims form again!

For times when receipts are required, members can now conveniently include them with their claim. They can scan and upload receipts when they submit online, OR take a picture and attach it with Manulife Mobile.

-

Poster

-

Poster

Home

Plan members can send documents online – quickly and securely

-

Plan members can quickly and securely send confidential documents through the plan member secure site. Sending information online means it can be processed quicker as members won’t need to mail or fax documents anymore.

Plan members have a secure way to send the following information and forms:

- Evidence of Insurability

- Overage student dependent

- Beneficiary designations

- BC Pharmacare/RAMQ

- Drug Prior Authorization

Members can send these documents as a PDF file or even as a picture file. To send a document to Manulife through the site, they just need to sign in, go to the Contact us tab and select Send documents.

-

Home

Access your mobile benefits card on your smartphone

-

Plan members can now access their mobile benefits card right on their smartphone. It’s easily accessible and is less likely to be misplaced.

Use the following materials to promote to your plan members.

Your plan members can learn more at Discover.

-

Home

Find registered care providers in an instant

-

The Provider Lookup tool allows plan members to find registered care providers in an instant from their smartphone.

Use the following materials to promote to your plan members.

Your plan members can learn more at Discover.

-

Home

Pharmacy saving search

-

Plan members can use Pharmacy savings search on their mobile device, to learn where they can conveniently find the lowest cost prescription(s) drugs in their current location.

Use the following materials to promote to your plan members.

Your plan members can learn more at Discover.

-

Home

Online claims

-

Plan members can enjoy improvements to the online claims experience such as:

- directing claims to be paid from their health care spending account (if applicable),

- submission of orthodontic claims online, and

- it's now it's easier for plan members to submit coordination of benefits claims online too!

Use the following materials to promote to your plan members.

Your plan members can learn more at Discover.

-