As you near retirement, you’ll need to start thinking about how to convert your savings into income, so that you can get the most out of your various savings and investment plans, ensuring a comfortable retirement income while keeping your taxes low.

First, let’s look at what you’ll get from the government

Canada Pension Plan/Québec Pension Plan

For both the CPP and QPP the amount of your retirement pension is 25% of the average monthly pensionable earnings on which you contributed to the Plan, if you file your application for a retirement pension at age 65. There is a maximum.

You are eligible for your CPP or QPP pension as of age 60. However, the earlier you retire before age 65, the less you will receive. You will be entitled to your full pension at age 65, and the more you postpone your retirement after 65, the more your benefits will increase, assuming you continue to contribute to the CPP/QPP.

Old Age Security (OAS)

The Old Age Security program is a Government of Canada program that provides you with a modest pension at age 65 if you have lived in Canada for at least 10 years.

Guaranteed Income Supplement (GIS)

The Guaranteed Income Supplement provides additional money, on top of the Old Age Security pension, to low-income seniors living in Canada.

Government programs provide you with some income. Now let’s look at the various payout plans for your savings.

Regardless of when you retire, you will be required to convert your registered savings into income by December 31st on the year you turn 71. There are a number of ways to do this.

You can buy a traditional annuity

A traditional annuity is a contract you purchase from an insurance company which provides regular payments either for life, with or without a guaranteed period or, in the case of an RRSP, to age 90.

Registered annuities are purchased with money accumulated in registered plans such as RRSPs, DPSP and registered pension plans.

The lump sum value in your registered retirement savings plans is converted into an annuity before tax. Only payments you actually receive are added to your taxable income. You normally cannot cash out an annuity; you can only receive periodic payments.

You can buy a RRIF or a prescribed plan

You can convert your RRSP and DPSP assets into a Registered Retirement Income Fund (RRIF), while your pension plan money can be converted to a prescribed plan.

What is a Registered Retirement Income Fund (RRIF)?

A RRIF is made up of the money that rolls over from your RRSP, as an RRSP cannot be kept after the age of 71. The money in a RRIF can only come from another RRIF, an RRSP or, when the money is not locked-in, another pension plan.

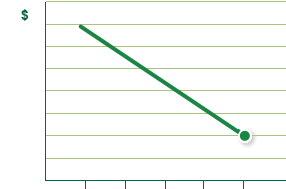

Under a RRIF, you can withdraw any amount of money from the plan at any time but a minimum withdrawal is required each year as prescribed by the Income Tax Act (Canada).

What is a prescribed plan?

A prescribed plan is like a RRIF but subject to pension legislation. This means the plan may have special restrictions (your money is locked-in) and your spouse may be entitled to certain rights under the plan.

There are different types of prescribed plans depending on the province or jurisdiction that governed your benefit under the pension plan:

- A Life Income Fund (LIF)

- A Locked-In Retirement Income Fund (LRIF)

- A Prescribed RRIF (PRRIF)

- A Restricted Life Income Fund (RLIF)

When you transfer money from a pension plan that is to remain locked-in, the document supporting the transfer will normally indicate the province or jurisdiction applicable so you don’t need to worry about this.

How the RRIF and prescribed plans work

The RRIF and prescribed plans provide you with a source of income after you retire or at the time you decide to withdraw from these funds. Like an annuity, these are all investment payout vehicles, although you can’t contribute to them except for transfers from eligible registered plans and on certain conditions.

The capital and interest accumulate tax-free, but are subject to tax when you make a withdrawal. Like an annuity, only the money you are paid is actually added to your taxable income. You get regular payments until the value of the plan is exhausted or you buy an annuity.

A prescribed plan is subject to the same minimum withdrawal as a RRIF and, with the exception of the PRRIF, it is also subject to a maximum withdrawal amount prescribed by the pension legislation.

Any withdrawal from a RRIF or a prescribed plan for an amount over the minimum will be subject to tax withholdings.

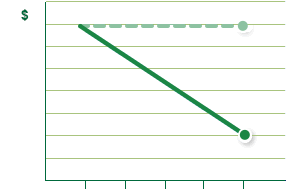

You can buy a combination of an annuity and a RRIF/prescribed plan

You can divide your registered assets between RRIFs/prescribed plans and traditional annuities. This gives you a good balance of income, long-term security and some protection against inflation.

You can cash out

In some cases, you may be able to take your accumulated RRSP assets in cash. The amount will be added to your income for the year when you file your tax return and will be taxed accordingly.

You may also access your TFSA and non-registered funds, in cash, at any time.

Now that we’ve covered the building blocks – saving your money, growing your money and getting your money – the next step is to see how you can work with your plans to get the most out of them.