Home

Digital Upgrade

-

We’re always looking for ways to make things easier and secure for plan members. In the coming weeks, we’re rolling out some new features to the mobile app and adding an extra layer of security to the plan member site.

What is happening to the app?

Manulife Mobile will have some new features.

- Notifications will allow us to give plan members a heads up when the app is down due to updates and outages.

- Plan members will be able to see how their funds are performing. In addition, units and unit share information for funds will be available.

- Plan members will have access to a suite of calculators.

- A new error tracking solution will allow for more robust reporting which will help us prioritize and resolve issues quickly.

The plan member site will have an extra layer of security!

In the coming weeks, when plan members sign in to the plan member site, they will be prompted with a security question.

We are laser focused on providing the best digital, customer-centric experience for plan members. Stay tuned for more to come.

Home

A new look for online accounts

-

The online experience members get is extremely important. After all, it’s where they can conveniently manage their account and keep track of their financial fitness.

That’s why we’re giving their online account (secure site) a fresh new look!

By updating everything from colours and fonts to the logos and menu bar, members will enjoy a more modern look. And the better visual experience will help them find what they need even easier.

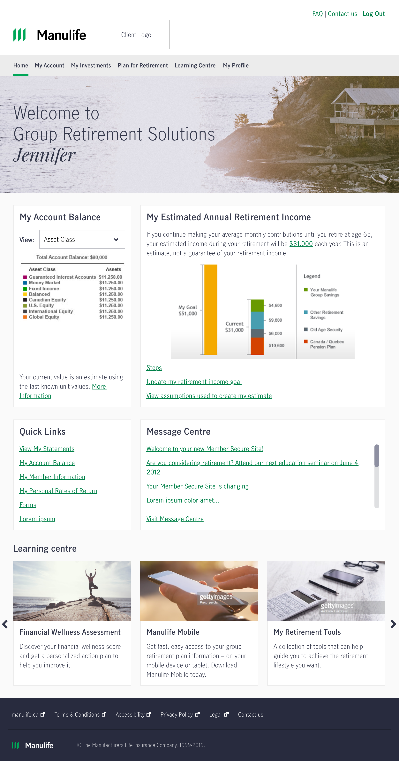

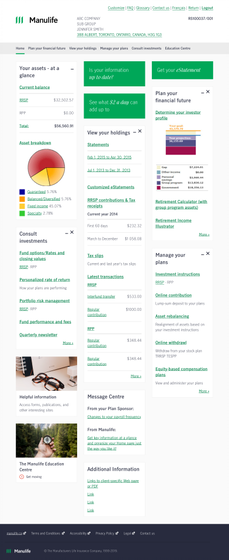

Here’s a sneak peek of the new homepage

The way the site functions and the tools/resources available will remain the same, but it will be easier on the eyes! A little can do a lot.

When is this happening?

The updates will go live automatically in the coming weeks. Watch for the new look soon!

What should you do?

Please encourage members to check out the updates. They can also access their account on the go, by downloading Manulife Mobile.

Home

New webinars for your employees in November

-

November is Financial Literacy month. It’s a great time to get people thinking about their money. And how to make smart decisions with it.

We know it can be hard. Sometimes it’s the little things that are the hardest. Like simply talking about money! The great news is, your employees can learn tips and tricks to tackle these at one of our webinars.

The webinar line up for November:

- Taking charge: your money, your decisions

- The money talk – with your partner

- The money talk – with your kids

- Don’t get a spending hangover this holiday season

Employees can sign up for any topic they like at manulife.ca/webinars.

A reminder about the webinars

Manulife’s webinar series gives employees a chance to learn what they want, when they want. With different topics covered each month, there’s something for everyone. They’re casual, interactive and focused on one main topic. This makes it easy for employees to retain the information and put the tips into use.

They’re 30 minutes. They’re live. And they’re free!

We’ve heard great feedback from plan members. They love this new learning style. We see more people participating when they’re invited by email. So, in the coming months, we'll start inviting groups of members to these webinars. It’ll introduce the webinar topics and invite them to sign up for a session.

Have questions?

Ask your Manulife representative.

Manulife’s webinar series is not offered to plan sponsors who are subject to public sector privacy legislation in British Columbia (British Columbia’s Freedom of Information and Protection of Privacy Act) and Nova Scotia (Personal Information International Disclosure Protection Act).

Home

Helping your employees make healthy money decisions

-

There’s always more and more online content vying for your employees’ attention - yet the average attention span is getting shorter all the time*. And employees don’t have a lot of time for learning.

Put yourself in their shoes. Imagine if your employees and their families could unlock money tips and ideas with short, LIVE webinars that can help them make healthy money decisions. All in an easy and relatable way, when it works for them.

Manulife’s webinar series

They say the first step is the hardest. So, we made it easy.

- 30-minute LIVE online sessions… free!

- Weekdays, evenings and weekends

- Simple tips and ideas

- Offered to all your employees

- Future webinars in multiple languages

Your employees can register for webinars and watch for what’s new at manulife.ca/webinars. Our sessions will cover 4 themes of an employee’s financial journey:

- Financial wellness

- Investments

- Making the most of your plan

- Retirement readiness

We will introduce new topics regularly. You can use this email to introduce your employees to the Manulife webinar series.

Your employees could WIN a $100 gift card

When they attend a webinar, and complete the survey sent after the session, they’ll be entered to win a $100 Visa gift card.

The surveys help us:

- Collect feedback

- Ask your employees what topics they want to learn about

- Improve future webinar experiences

Questions?

Contact your Manulife representative.

* Microsoft Attention Spans Research Report, 2015

Manulife’s webinar series is not offered to plan sponsors who are subject to public sector privacy legislation in British Columbia (British Columbia’s Freedom of Information and Protection of Privacy Act) and Nova Scotia (Personal Information International Disclosure Protection Act).

Home

Digital Upgrade for Manulife Mobile

-

We’re always looking for ways to make things easier for plan members. In the coming weeks, we’re rolling out some new features to our mobile app.

What is happening to the app?

Manulife Mobile will have some new features.

- Notifications will allow us to give plan members a heads up when the app is down due to updates and outages.

- Plan members will be able to see how their funds are performing. In addition, units and unit share information for funds will be available.

- Plan members will have access to a suite of calculators.

- A new error tracking solution will allow for more robust reporting which will help us prioritize and resolve issues quickly.

We are laser focused on providing the best digital, customer-centric experience for plan members. Stay tuned for more to come.

Home

Can getting online, help you save more?

-

It’s true, when plan members connect to their plan online, they are more likely to save. Digital members save 2.7 times more in assets, on average, than members who aren’t online 1. Check out how going digital makes it easier to save.

What do plan members get online?

When plan members sign in to their Manulife account, they can track their savings, view their statements and more. And, with Manulife Mobile, plan members have quick, easy and secure access to help them stay connected on the go.

By signing in to the plan member site and downloading the app, they’ve got access to their accounts anytime, anywhere. That’ll make their lives easier, so let’s work together and get them online.

Why is this important?

Digital solutions can help encourage greater financial fitness and in turn, help plan members prepare for all of life’s moments. One of those moments is preparing for retirement. Saving today can help avoid becoming a statistic tomorrow.

Canadians within 10 years of retirement are supposed to be at their peak savings years, socking away money for retirement. But Shillington found the median value of retirement assets of Canadians age 55 to 64 is just over $3,000. 2

With access to their accounts right at their fingertips, plan members can stay connected and track their progress.

1 Manulife Canada, Group Retirement & Solutions MPS Database, 2019

2 https://www.cbc.ca/news/business/retirement-savings-broadbent-institute-1.3450084

Home

Member site updates

-

The online experience members get is extremely important. After all, it’s where they can conveniently manage their account and keep track of their financial fitness.

That’s why we’re giving their online account a fresh new look!

By updating everything from colours and fonts to the logos and menu bar, members will enjoy a more modern look. And the better visual experience will help them find what they need even easier.

Here’s a sneak peek of the new homepage

The way the site functions and the tools/resources available will remain the same, but it will be easier on the eyes! A little can do a lot.

When is this happening?

The updates will go live automatically in the coming weeks. Keep your eyes peeled!

What should you do?

Please encourage members to check out the updates. They can also access their account on the go, by downloading Manulife Mobile.

Home

Enhancing the digital experience

-

Your members expect a simple digital experience, and continual updates will help to keep up with their needs.

Manulife Mobile is a convenient way for members to connect with their retirement accounts anytime, anywhere.

With just a few clicks, members can see their accounts at a glance on Manulife Mobile. With a new, simplified view, meaningful savings information is placed prominently at the forefront. A swipe of the thumb will show plan balances and one-year performance metrics.

To keep the momentum going, we’re encouraging members to go digital. Throughout July-October we’ll connect with them directly, via email, to explain the benefits. When members register online and download the app, they’ve got access to their accounts anytime and anywhere.

That can help make their lives easier and improve their financial health, so let’s promote the member site and app whenever we can!

Home

Encouraging members to go digital

-

Your members expect a simple digital experience, and continual updates will help to keep up with their needs.

Not only are the member site and Manulife Mobile easy ways for members to connect with their retirement accounts, but they also have a new, convenient way to save online. They can easily top up their savings in their Group RRSP and TFSA, simply by adding Manulife as a payee on their secure bank site. This feature is available for most major banks.

To keep the momentum going, we’re encouraging members to go digital. Throughout July-October we’ll connect with them directly, via email, to explain the benefits. When members register online and download the app, they’ve got access to their accounts anytime and anywhere.

That can help make their lives easier and improve their financial health, so let’s promote the member site and app whenever we can!

Home

Saving is easier with online banking

-

Plan members can contribute to their RRSP and TFSA the same way they manage their day-to-day banking – Online!

Online banking allows plan members to make lump sum contributions to their Group RRSP and TFSA directly from their bank's secure site. This feature is available for most major banks.

With online banking, plan members have a new, convenient way of contributing to their savings. It’s as simple as adding Manulife as a payee on their secure bank site.

Your plan members can follow these simple steps to start contributing to their savings online.

How else are we simplifying the way members do business with us digitally?

We’re giving them a better experience on the plan member site and the mobile app.

Manulife Mobile provides quick, easy and secure access to help them stay connected anytime, anywhere. What’s more - plan members will have a new view of their account information. The app will have fewer clicks and provide more visibility than ever before! And coming soon, it will be easier to sign into both the plan member site and the mobile app.

We’re going to encourage members to go digital. This summer, we’ll communicate with them directly to explain the benefits. When members register online and download the app, they’ve got access to their accounts anytime and anywhere. That’ll make their lives easier, so let’s work together and get them online.

Home

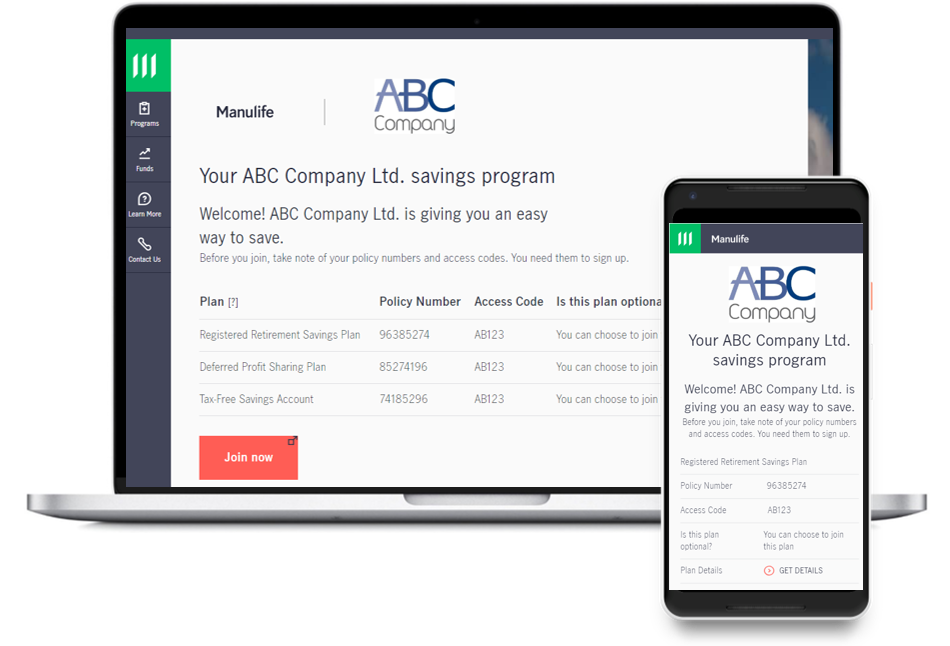

Guiding your employees from the start is as easy as ABC

-

Making financial decisions can sometimes feel overwhelming. In fact, more than 60%1 of Canadians reported that dealing with money causes them stress. This stress often leads to a state of inertia where they are unable to make any decisions2. Joining a group savings program can sometimes feel this way. We wanted to make it easier for everyone to join a group program and give them financial guidance at the beginning, so they can start saving for their future.

Introducing the Hub

Employees can access and navigate the Hub on any device, and easily find information about your plan and how to join. And the educational content makes it easier for employees to understand your group savings program and feel confident about their financial decisions.

How?

In 3 simple ways. The Hub is:

- Easy to access – it’s a website so it’s accessible when and where employees need it.

- Easy to navigate – the user focused design makes finding information easy.

- Easy to understand – simple and plain language educational resources can help guide their decisions

This customized turnkey solution will help employees take the first step toward making active financial decisions and increase their engagement and appreciation for your program. It’s a little step towards giving employees an easy, guided experience as they onboard.

Contact your Manulife representative for more information.

1 Manulife Financial Wellness Study – 2016 study

2 Emotional barriers to financial wellness - 2017 study conducted by Manulife / Homewood

Home

Putting the “fun” in investment funds

-

Saving for the future doesn’t have to be complicated. A few little steps can make a big difference. An engaging new video series is now available to help members take those little steps now, so they can be better prepared for tomorrow.

The series teaches plan members about investments in easy-to-understand terms. The videos are simple, entertaining, and best of all, under 3 minutes each.

The videos help take the mystery out of different types of investments and explain how members can choose an appropriate option. There are six videos covering:

- Diversification

- Asset classes

- Mutual funds

- Asset allocation

- Target date funds

- Target risk funds

These videos will be added to the VIP Room, and will also be available at enrolment, in education campaigns and in various communications.

Help your members take their first little step by sharing the videos with them, at manulife.ca/investmentbasics! You can also use this email to do it.

Questions? Contact your Manulife representative.

Home

A new way to contribute to savings

-

Plan members can contribute to their RRSP and TFSA the same way they manage their day-to-day banking – Online!

Online banking allows plan members to make lump sum contributions to their Group RRSP and TFSA directly from their bank's secure site. This feature is available for most banks.

With online banking, plan members have a new, convenient way of contributing to their savings. It’s as simple as adding Manulife as a payee on their secure bank site.

Your plan members can follow these simple steps to start contributing to their savings online.

How else are we simplifying the way members do business with us digitally?

Manulife Mobile provides quick, easy and secure access to help them stay connected anytime, anywhere. And coming soon, it will be easier to sign into both the VIP Room and the mobile app.

We’re going to encourage members to go digital. This summer, we’ll communicate with them directly to explain the benefits. When members sign in to the VIP Room and download the app, they’ve got access to their accounts anytime and anywhere. That’ll make their lives easier, so let’s work together and get them online.

Home

Updated Support Page

-

The Group Retirement Solutions Support page has been refreshed to provide better access to the secure site and help plan members manage their accounts online.

The new navigation makes it easier for plan members to find the information they need when they need it. Whether they are trying to enrol, make a contribution, make a withdrawal or change their personal information - the updated GRS Support Page can help guide them.

With a new streamlined layout, plan members will have an easier time selecting the correct action to take – and with step-by-step instructions along the way, plan members can quickly access the secure site and complete transactions with ease.

With quick, easy access to the tools they need, plan members can make the most of their digital experience.

Home

A seamless connection

-

Manulife Mobile provides quick, easy and secure access to help plan members stay connected anytime, anywhere! With Touch ID® and Face ID® for Apple® users and fingerprint authentication for Android™ users, plan members can track their savings and access their group benefits plans on the go.

And – We want to know how we’re doing. Rolling out soon, plan members will be able to tell us what they think about Manulife Mobile directly through the app itself. No need to go to the App or Google Play stores to provide feedback. Soon, plan members will be able to provide their feedback the same way they access their group savings and benefits information - right at their fingertips!

Plan members can download Manulife Mobile for Apple and Android today! And for more information, visit manulife.ca/mobile.

Apple, iPhone Face ID and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. Android is a trademark of Google LLC.

Home

Email Notification & Statements

-

Plan members can use their time for the things that matter most.

Effective now, when plan members submit a withdrawal form via paper, email or fax, we’re going to confirm receipt of the transaction via email. With this notification, plan members no longer need to call Manulife to confirm we’ve received their request - saving them some time.

In addition, plan members will now have access to their statements online for 7 years! We’ve extended the statement retention period from 3 years to 7 years. This gives members better access to historical data that they can retrieve on their own. Plan members will see a message on the plan member secure site informing them of this change in the coming weeks.

We’re always looking for ways to improve the experience for you and your members. Stay tuned for more updates in 2019!

Home

Access on the go

-

Technology has changed the way we live. Today, we can go online to find almost anything we want, anytime we want. It’s all right there - accessing retirement savings information is just as easy.

With the Manulife Mobile app, plan members can view their savings totals and plan details, recent activity, contribution history and rates of return. All of this in addition to having access to their Manulife group benefits accounts, right at their fingertips!

For even easier access, Apple® users can use Touch ID® and Face ID® and Android™ users can use fingerprint authentication.

What can you do? Promote the Manulife Mobile app and help make your plan members lives easier by encouraging them to go digital! Going digital provides a better customer experience - reduced phone calls, no more waiting for mail, access to personalized content quickly and easily.

-

Plan members can download Manulife Mobile for Apple and Android today! And for more information, visit manulife.ca/mobile.

Apple, iPhone Face ID and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries.

Android is a trademark of Google LLC.

Home

Time to think about taxes

-

Educate on tax slips and tax receipts

For plan members who want to get a jump on doing their taxes or for those who can’t find a receipt, you can use this campaign to promote how easy and quick it is to access their tax slips and receipts online. It includes an email, a flyer and a blog. Some of the tax slips and receipts (for the 2018 taxation year) are already available online and others will be added at the end of February. For contributions made within the first 60 days of 2019, receipts will be available later in March.

Promote investing bonus

Employees may not be aware that their hard-earned bonus can put them in a higher tax bracket, and that they could be paying a higher tax bill if they take the bonus as cash. As this campaign suggests, investing the money in their company RRSP will defer taxes and accelerate their savings. The campaign includes an email, a blog, a poster and a video.

Log in to the plan sponsor secure site and select Educate your members to discover these two new campaigns and all the other topics available to help plan members make the most of their group retirement program.

Home

Getting ready for tax time

-

Educate on tax slips and tax receipts

For plan members who want to get a jump on doing their taxes or for those who can’t find a receipt, you can use this campaign to promote how easy and quick it is to access their tax slips and receipts online. It includes an email, a flyer and a blog. Some of the tax slips and receipts (for the 2018 taxation year) are already available online and others will be added at the end of February. For contributions made within the first 60 days of 2019, receipts will be available later in March.

Promote investing bonus

Employees may not be aware that their hard-earned bonus can put them in a higher tax bracket, and that they could be paying a higher tax bill if they take the bonus as cash. As this campaign suggests, investing the money in their company RRSP will defer taxes and accelerate their savings. The campaign includes an email, a blog, a poster and a video.

Log in to the plan sponsor VIP Room and select Educate your members to discover these two new campaigns and all the other topics available to help plan members make the most of their group retirement program.

Home

Supporting members through critical life moments

-

We recently asked plan members to help us identify moments in life that cause them the most financial and emotional stress. In total we’ve identified 18.

Here’s what they had to say:

-

- Birth of a child

- Child comes of age

- Overage dependent

- Joining of families

- New job

- Leaving a job

- Marriage/partnership

- Critical illness/ injury

-

- Retirement

- Receiving an inheritance

- Life policy maturing

- Buying your first home

- Paying off your mortgage

- Divorce

-

- Death of a loved one

- Bankruptcy

- Transition to long term care

- Living through a disaster or catastrophe

-

We wanted to do something to help them alleviate some of this stress. As a result, the Life Moments team was born.

What does this mean to plan members?

No more having to call multiple numbers during these sometimes-difficult times. The Life Moments team, will serve as a single point of contact.

18 life moments are a lot! So, we’ve decided to tackle these one at a time, starting with the death of a loved one. When the Life Moments team gets a call to notify them of the passing of a plan member, they’ll run a search for other possible products the member might have with Manulife. Once they have all the information they need, they’ll coordinate all necessary notifications across the organization on behalf of the caller and get the claims process started. We want to make this time as easy as possible for members and having a single point of contact, is a step in the right direction.

Over the next couple of months, we’ll look to help members with additional life moments.

If you have any questions, reach out to your Manulife Representative.

Home

Manulife Personal PlanTM

-

A fresh look for the Manulife Personal Plan™, including GRIP

We’ve been working on improving the Manulife Personal Plan, including the GRIP, to help make saving easier for plan members once they leave their employer sponsored plan, and help them make the most of their savings once they retire. On April 1, 2018, we’ll be making additional changes. Here are the highlights:

- Revised Member Reward Program, including automatic account linking, giving members opportunities to earn more rewards on assets in the Manulife Personal Plan

- Lower investment management fees on several funds for retirees (GRIP)

- A new fee structure, to bring it in line with industry practice, and encourage members to save.

For more information on the upcoming changes, speak to your Manulife Representative.

Home

Bigger & Better Benefits with Banking

-

We believe with the right resources, employees can lead happier, healthier lives – and when they do, organizations become stronger and healthier too. That’s why we’ve partnered with Manulife Bank to revolutionize our benefits.

Exclusive bank offers that can help put more than $3,000 back in plan members’ pockets in the first year!*

Manulife Bank’s all-in-one solutions are simple and flexible. No more hidden fees, misleading offers or superficial rewards. Your plan members could get value they may not be experiencing with their bank today.

- Manulife Bank’s Advantage Account – High interest & free unlimited banking*

Canada’s most useful savings account according to the Globe and Mail, it combines chequing and savings with no monthly fee

SPECIAL OFFER FOR PLAN MEMBERS: Always receive our highest promotional interest rate (3%, subject to change) - Manulife One all-in-one mortgage, daily banking and line of credit*

Can help save thousands in interest and be debt free sooner

SPECIAL OFFER FOR PLAN MEMBERS: $1,000 cash back after the account has funded - ManulifeMONEY+TM Visa† cash back credit cards*

Plan members can accelerate their cash back rewards on groceries and everyday spend

Read the brochure for more details about these solutions and exclusive offers.

Read the brochure for more details about these solutions and exclusive offers. Available in December 2018 for all your group retirement plan members

Access to these exclusive bank offers requires no work on your part, and we’ve developed a simple and engaging experience for your plan members. We’ll post a banner on the homepage of the plan member secure site and VIP Room and a simple click will take them to more information. It’s that easy.

Questions?

Talk to your Manulife Representative to learn more about these exclusive bank offers.

* Some terms and conditions apply.

†Trademark of Visa International Service Association and used under licence.

- Manulife Bank’s Advantage Account – High interest & free unlimited banking*

Home

A new campaign on the education resource centre

-

A new addition

Your plan members have worked hard to save towards their retirement but now what?

We’ve compiled a new education campaign with several tactics to help them learn more about the different income options available to them.

Log in to the plan sponsor secure site and select educate your members to access and promote the new campaign.

Home

Manulife Mobile

-

Technology has changed the way we live. Today, we can go online to find almost anything we want, anytime we want. It’s all right there - accessing retirement savings information is just as easy. Plan members can now access the VIP Room on the go!

With the Manulife Mobile app, plan members can view their savings totals and plan details, recent activity, contribution history and rates of return. All of this in addition to having access to their Manulife group benefits accounts, right at their fingertips!

For even easier access, Apple® users can use Touch ID® and Face ID® and Android™ users can use fingerprint authentication

What can you do? Promote the Manulife Mobile app and help make your plan members lives easier by encouraging them to go digital! Going digital provides a better customer experience - reduced phone calls, no more waiting for mail, access to personalized content quickly and easily.

-

Plan members can download Manulife Mobile for Apple and Android today! And for more information, visit manulife.ca/mobile.

Apple, iPhone Face ID and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries.

Android is a trademark of Google LLC.

Home

Hello. ¡Hola! Ciao! Namasté.

-

Did you know that we can offer your plan members the convenience of talking to us in over 150 languages?

Thanks to our partnership with LanguageLine Solutions®, we have access to a team of nearly 9,000 professional interpreters that know and understand our business.

How it works

It’s simple. A member calls in to Customer Service. They’re looking for information on their group retirement savings plan, but English or French isn’t the language they’re most comfortable speaking. All they do is let the Customer Service representative know and they’ll conference in an interpreter to help. This is at no cost to the plan member.

Understanding and getting answers to questions about their plan is a lot easier for your members when there’s no language barrier. Spread the news using the email template we provided.

Home

Retirement Redefined

-

A one-of-a-kind program for a one-of-a-kind retirement

Retirement Redefined is a free service for members aged 50+ that helps them prepare for the lifestyle they want in retirement – with the finances, health and well-being to enjoy it. How?

- With a holistic digital retirement planning platform, employees create a personalized goal-based retirement vision focused on their interests and needs. Combined with our exclusive online content, calculators, tips and tools, they will design a custom, flexible action plan to get them to their big day.

- With access to a team of life licensed Retirement Counselors, employees are never alone. They are always a call or email away and happy to ensure employees have the support they need to achieve their retirement goals.

See how we make this solution come to life.

Let us help you empower your employees to make the most of their after-work years with Retirement Redefined. Contact your Manulife Representative today to get started.

Home

Online fund pages

-

Fund pages can conveniently be viewed on any device at manulife.ca/findmyfunds.

The website is so easy to use. For each fund the employee wants more information about, they simply type the fund code from the rate of return overview into the search box. It’ll open the fund page in a new browser tab.

The website also has some short education videos that employees can watch to learn more about various topics, like the benefits of having a group plan, investing and fees.

Moving fund pages online means you and your employees can enjoy these advantages:

- Convenience

- Quick and easy – no print and shipping time

- Available 24/7 on various devices

- A new layout and simpler words

- Greater opportunity for variety and interaction with videos, links etc.

- More organized thanks to less paper clutter

- Environmentally friendly

All online fund pages meet current accessibility standards.

- Convenience

Home

Interesting and exciting things are coming!

-

Digitizing the experience for you and your employees means you will enjoy these benefits:

- Convenient access to materials

- Quick and easy – no print and shipping time

- Available 24/7 on various devices

- Greater opportunity for variety and interaction with videos, links etc.

- More organized thanks to less paper clutter

- Environmentally friendly

Stay tuned for more information in the coming months.

- Convenient access to materials

Home

Manulife Mobile has Face ID for iPhone X users

-

Manulife Mobile users can access their group retirement information securely and easily with the addition of Face ID® facial recognition technology, available exclusively for Apple® iPhone X users.

Face ID provides intuitive and secure authentication enabled by the state-of-the-art TrueDepth camera system with advanced technologies to accurately map the geometry of a [user’s] face1. This technology allows users to sign into Manulife Mobile with a simple glance. Face ID securely unlocks Manulife Mobile making it easier for plan members to access their group retirement information.

Once a user sets up Face ID on their mobile device, they can enable and disable the feature through the app anytime. They can also continue to enter their password to sign in.

1 https://support.apple.com/en-ca/HT208108

Apple, iPhone and Face ID are trademarks of Apple Inc., registered in the U.S. and other countries. -

Home

Online withdrawal is available for NRSPs

-

We’re simplifying and accelerating the withdrawal process for NRSPs. Online withdrawal is available for both new and existing NRSP plans.

Plan members no longer have to find, fill out, and submit paper forms. This service is automatically added to NRSP policies, unless there are withdrawal restrictions, or if the group program also has a TFSA. Clients that have an NRSP and a TFSA can submit a request to have this feature added to their NRSP plan only.

How it works

Online withdrawal allows members to transfer assets from their group non-registered savings plan to a personal bank account directly from the plan member secure website. Plan members can make a withdrawal once per day up to a maximum of $20,000 per withdrawal. Usual withdrawal fees apply. Payment can only be sent via Electronic Fund Transfer.

For your convenience, once online withdrawal is available for your plan - either automatically added or by request - we’ve provided a message to pass along to your members informing them of this feature.

-

Home

Contribution Limit Tracking

-

If you offer a group Registered Retirement Savings Plan (RRSP) or Tax-Free Savings Account (TFSA), the contribution limit tracking service can help your members avoid the penalties and tax audits that can come from over-contributing to their plans.

How it works – In the VIP Room, members enter their RRSP limit from their Canada Revenue Agency (CRA) notice of assessment, or TFSA limit given in the CRA guidelines, and their email address.

We will track their contributions to their Manulife plans and alert them by email when they reach 85% of their contribution limit. Once a year they’ll get a reminder to update their contribution limit.

There is no additional cost. You can ask to add the service to your group RRSP or TFSA plan at any time. Please note this service is not available to Express clients.

If you don’t currently offer a group RRSP or TFSA but are considering doing so, they can be an excellent addition to your group program. And we’re making these plans even better with features like contribution limit tracking.

Home

The Manulife Personal PlanTM to replace The Advantage Program

-

Plan members leaving their employer sponsored group retirement plan with Manulife will soon be able to find everything they need in The Manulife Personal PlanTM, which replaces the Advantage Program.

Starting November 1, 2018, these members will experience the same hassle-free transition into The Manulife Personal Plan, where they’ll find group savings and group retirement income options to make saving easier, and features that can help them make the most of their savings.

We are also modifying the termination process for plan members leaving your organization.

Find out more

Read the flyer for details on the Manulife Personal Plan, the new termination process, and what will happen next.

-

About The Manulife Personal Plan

Home

Adding electronic beneficiary signature to the GRS online enrolment

-

Employees enrolling in their GRS plan online will see a new electronic signature feature when naming their beneficiary. This will take the place of having to print, sign and return a form to Manulife after they enrol. Once they finish enrolling online, they’ll be ready to go! For now, this feature is only for the online enrolment experience.

Improving the GRS online member enrolment experience

The electronic beneficiary signature is just the beginning. We’ve started work on a brand new online member enrolment experience! We’ve completely re-imagined how to get employees informed and enrolled in their plans with Manulife. The experience will be shorter and simpler. It’ll include information in a way that’s easy to understand. And employees will be able to use any internet-enabled device they want to do this.

More on this in the coming months!

Home

Financial Wellness Assessment

-

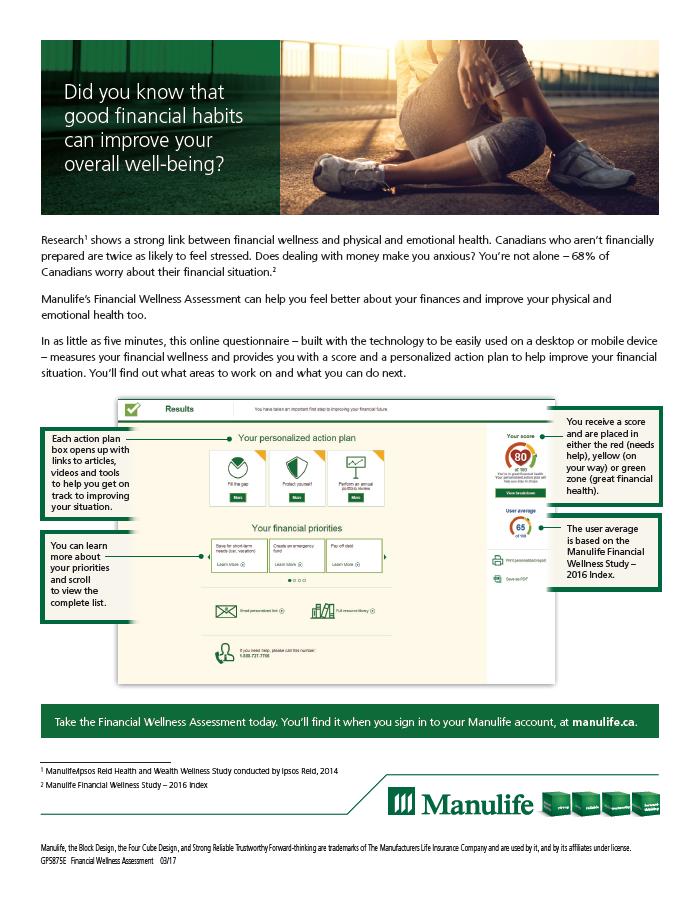

Plan members can easily measure where they stand financially with Manulife’s Financial Wellness Assessment. They will find the assessment when they sign in to their Manulife account at manulife.ca/GRO or in the VIP Room.

Use the following material to promote the Financial Wellness Assessment with your members.

-

Home

New Mobile App

-

The new combined—Group Benefits and Group Retirement sign in features are now available!

Online sign in page—allows members to easily access both their group benefits and retirement accounts from a single page.

'Manulife Mobile' app for Apple and Android—allows members to access their benefits and retirement savings for both their group plans with Manulife. We've combined all the features of our existing apps into one.

Use the following materials to promote to your plan members.

-

Poster

-

Email template