Defined Contribution Pension Provisions

(DCPP for Western Canada employees and DCPP for Eastern Canada employees)

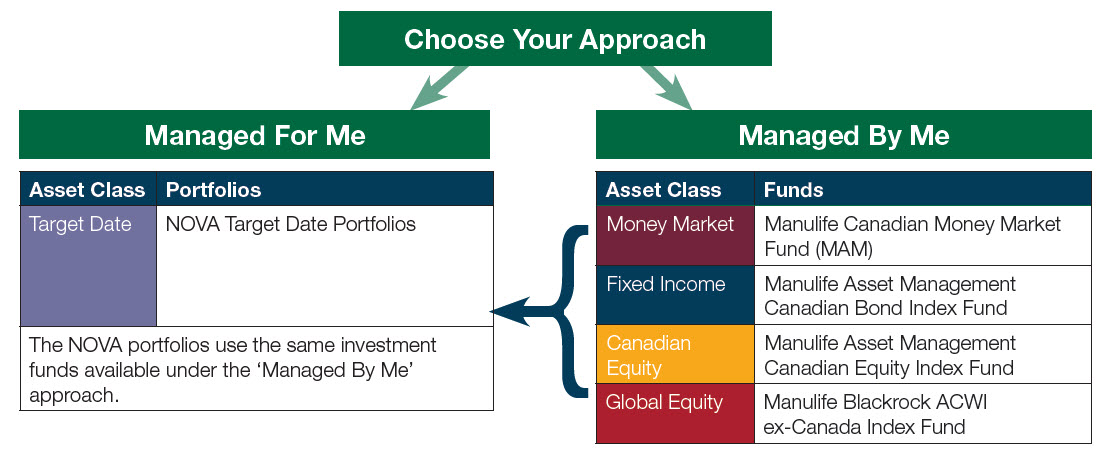

Before you select investments for the DCPP, you must first determine which approach for managing your investments best suits you. Two distinct investment approaches are provided for you. Once you have decided which approach you prefer, you will be able to select either a Target Date Portfolio (TDP) or individual funds.

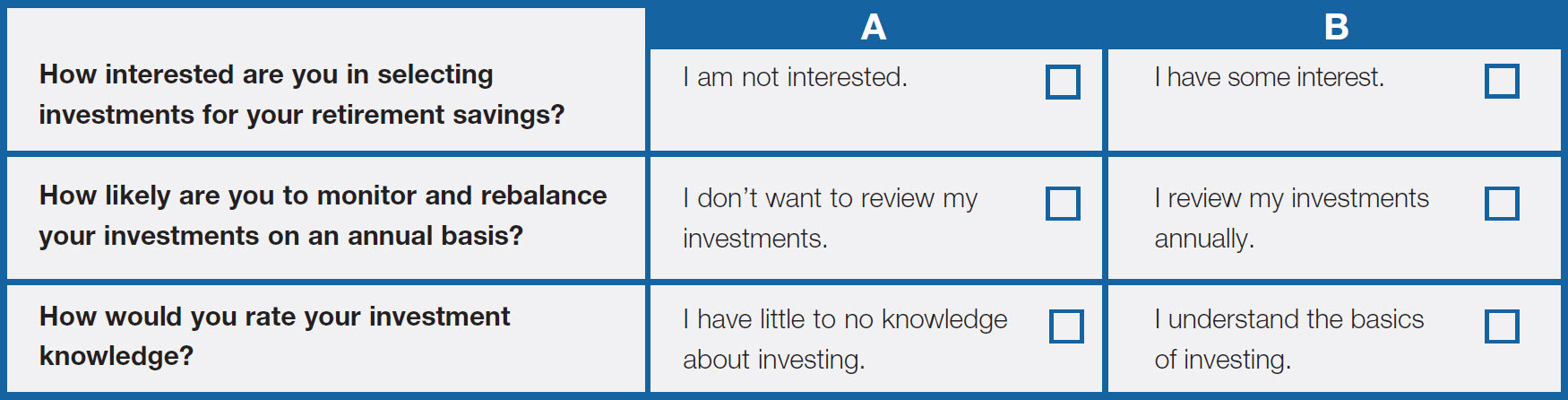

In your Enrolment Guide (The Defined Contribution Pension Provisions of the Retirement Plans for Canadian Salaried Employees of NOVA Chemicals Corporation) you have the opportunity to answer the three questions below to help you determine whether should have your portfolio managed for you or manage your own portfolio.

If you chose two or more responses from column A, the indicated investment approach for you is the Managed For Me approach. Conversely, if you chose two or more responses from column B, the Managed By Me approach is suggested

Once you have decided on your approach you will be able to select from a series of Target Date Portfolios for a Managed For Me approach or from individual funds for Managed By Me approach.

| As a member of the DC Pension Provision you can invest in either the Managed For Me or Managed By Me approach, but not both at the same time. If you select the Managed For Me approach you can only select one Target Date Portfolio. |

Managed For Me Approach

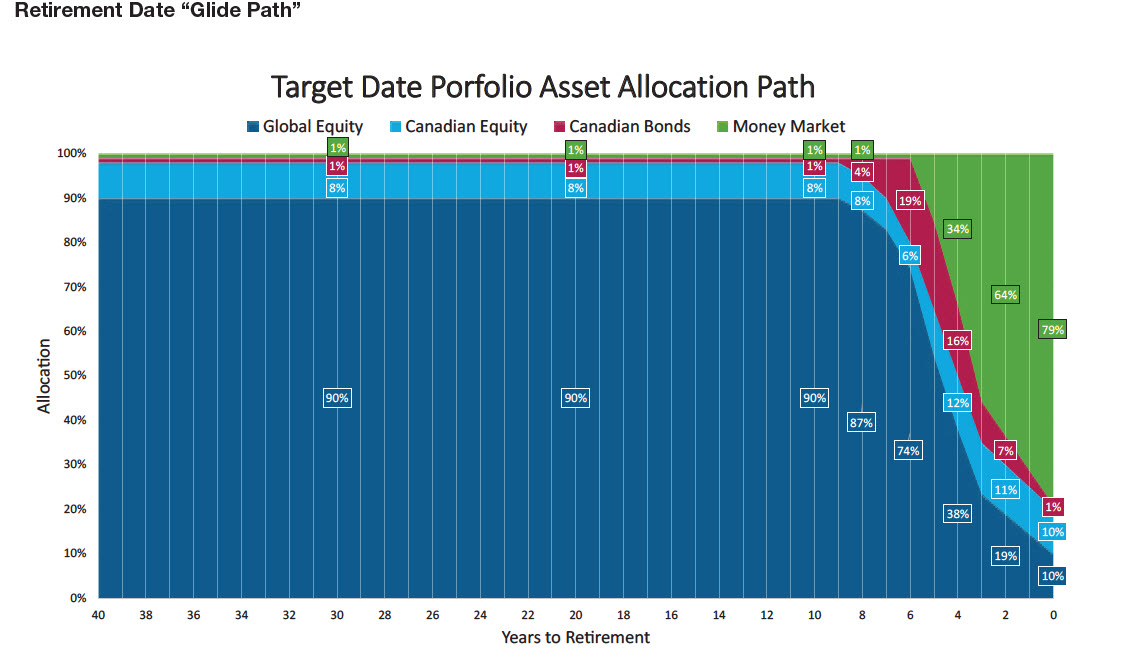

The DCPP offers TDPs to simplify the management of your retirement account. TDPs are designed to let you make an investment choice simply by selecting the portfolio with a date for the year when you intend to retire and begin drawing a retirement income. The TDP invests your assets in individual funds with an appropriate asset mix based on your time horizon to retirement to help you meet your retirement savings objectives. In the period up to ten (10) years before retirement, equity investments predominate in order to maximize the long-term return potential. Although year by year returns will be quite volatile, over sufficient time (at least 10 years) good years tend to more than offset bad ones. As you get closer to your chosen retirement date, the asset mix of your portfolio is reweighted automatically to become more conservative.

The composition of the TDPs has been custom-designed by NOVA Chemicals with assistance from Manulife Asset Management. Manulife does not decide the underlying funds and asset mixes. You as a plan member must determine the suitability of this investment for your overall investment strategy.

Simply chose your TDP and its composition will be managed for you. As you approach your chosen retirement year, the asset mix inside your portfolio is reweighted automatically to become more conservative.

Determine your portfolio code

The portfolio code starts with the letter P, followed by your retirement year, then the letter U. For example, if you plan to retire in 2032, your portfolio code would be P2032U. You must choose a target retirement year between age 55 and 71.

P----U

(your retirement year)

Default Investment Option

If you do not select your investments, your assets will be invested in the NOVA Chemicals TDP with the target date of your normal retirement date age of 65. Your plan’s default investment is intended as a temporary destination for your contributions and may not be appropriate for your long-term retirement planning.

Managed By Me Approach

- Suitable for members that prefer to manage their own investments or may want a specific level of risk/return.

- Provides a reasonable amount of flexibility – members can build a customized portfolio to achieve their desired level of risk/return.

- Offers an optional automatic rebalancing service – Once activated, your allocation should be revisited over time as your time horizon and risk tolerance changes.

The funds available to you to manage your own portfolio are listed below. It is important to note that the NOVA Target Date Portfolios (for the Managed For Me approach) use the same investment funds available under the ‘Manage By Me’ approach.

| Asset Class | Fund |

| Money Market | Manulife Canadian Money Market Fund (MAM) |

| Fixed Income | Manulife Asset Management Canadian Bond Index Fund |

| Canadian Equity | Manulife Asset Management Canadian Equity Index Fund |

| Global Equity | Manulife Blackrock ACWI ex-Canada Index Fund |

Investor Strategy Worksheet

To help you discover your investor style, click here and answer the following eight questions. Knowing your investor style will ensure you select the right funds for you.

Click here to find sample asset allocations that fit different investor styles.

Tips to help:

- Each asset class in the sample portfolio is represented by a different colour, and each fund’s description is printed in the colour that represents its asset class. For example, blue for fixed income.

- To learn more about a fund, select the fund name to read the fund description, commentary and review. Click here for tips on the fund descriptions and analyzing the data contained in them. Note: past performance is no guarantee of future results.

Rates of return

Review the rates of return for the funds available through the NOVA Chemicals DCPP. These rates of return represent past performance and past performance cannot guarantee future results.

What are Investment Management Fees (IMF) and Operating Expenses (OE)?

An IMF is the expense a member who participates in a investment fund pays for professional services required to manage the investments of the fund.

Typically the IMFs paid by members participating in group retirement plans are significantly lower than those available to individual investors, such as mutual funds. The lower the IMF, the better it is for participating members as more of their contributions and investment earnings remain in the fund to grow for retirement.

An OE is the expense the member also pays to cover the costs of establishing, operating and maintaining an investment fund, and includes, but not limited to, legal, audit, trustee, custodial, fund/unit valuation and reporting activities. These expenses apply to certain Manulife segregated fund(s), and if applicable, also to the underlying fund(s) in which the Manulife fund invests.

The chart below shows you the composition of the annual rate of fees associated with your investment funds.

| Manulife Fund Name | IMF* | SFOE** | UFOE*** | Total |

| Manulife Canadian Money Market Fund (MAM) | 0.090% | Included in IMF | Included in IMF | 0.090% |

| Manulife Asset Management Canadian Bond Index Fund | 0.095% | Included in IMF | 0.010% | 0.109% |

| Manulife Asset Management Canadian Equity Index Fund | 0.080% | Included in IMF | 0.020% | 0.105% |

| Manulife Blackrock ACWI ex-Canada Index Fund | 0.170% | 0.030% | 0.097% | 0.274% |

| NOVA Target Date Portfolios (assembled from the above Funds) | 0.097% to 0.161% | Prorated by Funds weights | Prorated by Funds weights | 0.110% to 0.257% |

*Investment Management Fee, **Manulife Segregated Fund Operating Expense, ***Underlying Fund Operating Expense Note: Operating expenses are as of December 31, 2017

How do the IMF and OE affect the unit values of the investment funds?

While IMFs are deducted from unit values on a pro-rated basis every day, they are shown as an annual figure on statements and on the secure plan member site. An annual investment related fee of 0.090% would be stated as 9 basis points (bps). The OE fees are deducted by Manulife as they occur prior to determining the unit value of the segregated fund.

Underlying fund operating expenses.

In some cases, these expenses are paid by the underlying fund itself, and will be shown as a separate and distinct amount. The stated amount will appear as a percentage of the Manulife fund’s assets and will fluctuate from year to year. Manulife has no control over these expenses.

In other cases, they are included in the IMF so that a single fee is reflected to represent all the services related to operating the segregated fund.

The description page produced for each fund available will note how the underlying fund’s operating expenses are reflected. To see details of an underlying fund’s operating expenses, click on the name of the fund to open its information page. Details of underlying fund operating expenses will appear near the top of the page.

What taxes are charged?

The federal Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) in effect in some provinces is applied to the IMF and to applicable portions of the OE. These tax amounts are also deducted from the value of the fund. No additional charges are applied against the value of Manulife’s segregated funds.

Managed by Me approach only

Why rebalance?

If you choose individual investment funds to manage your own portfolio, you may wish to consider this service. When you enrol, you will be asked to specify the percentage of your contributions to be invested in each fund you select. However, the performance of each of your investments will fluctuate at different rates and at different times. Thus, the percentage of your account invested in each fund will diverge over time from your latest instructions.

For example, if you wish to invest 60% of your contributions in equity funds and 40% in fixed income funds, you set your contributions to follow these instructions. Over time, for example, the equity portion of your account could grow faster becoming say 70% of your account while the fixed income portion falls to 30%. This would have significantly increased the risk level of your account and it may no longer correspond to your investor profile. The quarterly rebalancing service keeps your account in line with your investment instructions.

To rebalance your account to reflect your investment instructions, Manulife will transfer money from the funds that are ‘overweight’ to those that are ‘underweight.’

Details about this service

- If you choose to sign up for this service, your account will be automatically rebalanced quarterly to reflect your instructions for ongoing contributions.

- The funds in your account will be rebalanced if the percentage of your money invested in any fund differs from your current investment instructions by more than 2.5%.

- Asset rebalancing within your account will occur once you have a minimum of $2,500 invested in market-based funds.

How to activate this free service?

You will have the option to select this service during your online enrolment. If you want to activate this service after your initial enrollment:

- Log in to your account

- From the top navigation bar click on the My investments link.

- Select the Automatic Asset Rebalancing instruction link found under the Automatic Asset Rebalancing section.

Need help choosing your investments?

Manulife's licensed Financial Education Specialists can assist you Monday to Friday, from 9 a.m. to 5 p.m. ET at 1-888 727-7766.