|

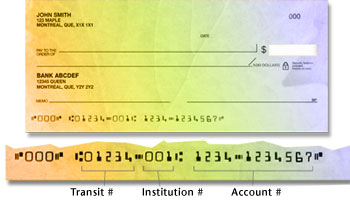

To invest a one-time contribution in one of your plans using this feature, you must select your investment instructions (choose existing instructions, or create specific instructions for the contribution) and provide the following information about the bank account from which money will be withdrawn:

- type of account used (chequing or savings)

- financial institution and branch (transit) number

- account number

- amount to be contributed to your plan.

Bank account information will be retained for future contributions you make using this feature; the information saved will always be that which was provided for the previous online contribution. If necessary, you may change your bank information before submitting your next request. If you notice any error in the bank account information which was submitted for an on-line contribution, please contact Manulife immediately at 1 800 242-1704.

All on-line contributions submitted after 4:00 PM (Eastern Time) will be invested on the next business day.

The minimum amount that may be invested through on-line contribution is $25.

Frequently Asked Questions

What is the maximum amount I can put in my RRSP?

The maximum annual contribution towards an RRSP allowed by the Income Tax Act must not exceed the lesser of the following amounts:

18% of the previous year's earned income less the pension adjustment (PA shown on your T4 slip) for the previous year, plus the pension adjustment reversal (PAR), if applicable.

OR

Pre-established government maximums:

| 2010 |

= |

$22,000 |

| 2011 |

= |

$22,450 |

| 2012 |

= |

$22,970 |

| 2013 |

= |

$23,820 |

| 2014 |

= |

$24,270 |

| 2015 |

= |

$24,930 |

| 2016 |

= |

$25,370 |

| 2017 |

= |

$26,010 |

| 2018 |

= |

$26,230 |

| 2019 |

= |

$26,500 |

| 2020 |

= |

$27,230 |

In addition to these maximums, unused amounts from previous years since 1991 can be added to the maximum you can contribute to your RRSP in a given year. Since 1992, your Notice of Assessment indicates your maximum eligible RRSP contribution amount including the unused portion.

What is the pension adjustment reversal (PAR)?

The PAR re-establishes lost RRSP contribution room for individuals that change jobs or move in and out of the workforce. It is calculated for all members who cease to participate in a Registered Pension Plan or a Deferred Profit Sharing Plan and for whom a benefit was paid before retirement (through a transfer or reimbursement).

For more complete details, refer to the Pension Adjustment Reversal in the Helpful information section.

What is a Spousal RRSP?

This is an RRSP you take out in your spouse's name. Your spouse is the owner of the plan, but any contributions you make are tax-deductible for you in the year you make the contribution. Note the combined amount you contribute to both plans must not be higher than the RRSP maximum shown on your Notice of Assessment issued by the Canada Revenue Agency.

Setting up a spousal plan is beneficial when your spouse is in a lower tax bracket than you at the time the funds are withdrawn, since your spouse will pay the tax on the amount withdrawn from their plan.

Can my unused contributions be carried forward?

Yes, until the end of the year you turn 71. The exact amount you can contribute for the current taxation year, which includes any unused contribution room from previous years, is shown on your Notice of Assessment.

When can I claim RRSP contributions?

On your annual income tax return, you can claim RRSP contributions made in the previous calendar year, as well as any contributions you made during the first 60 days of the current calendar year. Manulife mails out receipts semi-annually -- the first 60 days of each year, and the remaining 305 days.

Is there a maximum age for contributing to my RRSP?

You can make tax-deductible RRSP contributions until the end of the year in which you turn 71. You can also contribute to your spouse's RRSP until the end of the year in which he/she reaches 71.

What is the maximum amount I can put in my TFSA?

The maximum annual contribution towards a TFSA allowed by the Income Tax Act must not exceed the following pre-established government maximums:

2009 up to 2012 = $5,000

2013 and 2014 = $5,500

2015 = $10,000

2016 up to 2018 = $5,500

2019 = $6,000

2020 and afterward = Indexed based on the inflation rate and rounded to the nearest $500

Unused TFSA contribution room is carried forward and accumulates in future years.

Also, full amount of withdrawals can be put back into the TFSA in future years. Re-contributing in the same year may result in an over-contribution amount which would be subject to a penalty tax.

Your total contribution room for a specific year is made up of

- your maximum annual contribution for that year;

- your unused TFSA contribution room carried forward from the previous year; and

- the full amount of your withdrawals made from a TFSA in the previous year.

Your TFSA contribution room information can be found by going to one of the following services available on the Canada Revenue Agency website (www.cra-arc.gc.ca) or by phone:

- My Account; or

- Tax Information Phone Service (TIPS). The number to call is 1-800-267-6999.

Is there a maximum age for contributing to my TFSA?

You must be at least age 18 to open a Tax Free Savings Account but there is no age limit to contribute or keep your money growing tax free.

Can I use my TFSA contributions to reduce my income tax?

No, TFSA contributions are not tax-deductible.

Can I contribute to a Spousal TFSA?

Contrarily to a RRSP, you canít setup and contribute to a Spousal TFSA. However, the Canada Revenue Agency allows you to give funds to a spouse or common-law partner for them to invest in their TFSA without that amount, or any earnings on the amount being attributed back to you. By doing so, it is important to make sure that the total of all contributions your spouse or common-law partner makes to their TFSA does not exceed their TFSA contribution room.

- My Account; or

- Tax Information Phone Service (TIPS). The number to call is 1-800-267-6999.

|

Legal and privacy statement | © 2017 Manulife. All rights reserved.

Legal and privacy statement | © 2017 Manulife. All rights reserved.